This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

About 3.2 billion people, nearly half the world population, are at risk for malaria. In 2015, there are about 214 million malaria cases and an estimated 438,000 malaria deaths.

Did you know?

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Did you know?

Your heart beats over 36 million times a year.

Did you know?

The B-complex vitamins and vitamin C are not stored in the body and must be replaced each day.

Did you know?

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

Elephants do not fully digest their food. Other animals, such as this Baboon may pick through elepha

Elephants do not fully digest their food. Other animals, such as this Baboon may pick through elepha

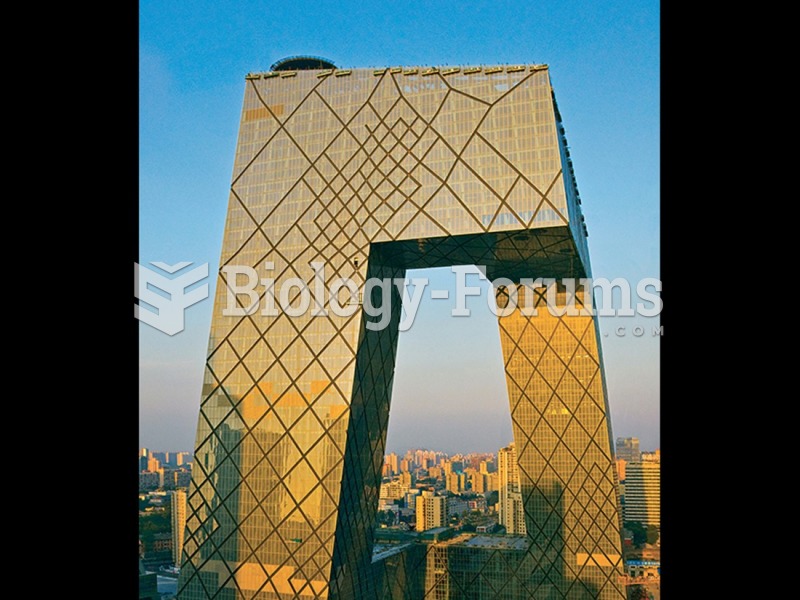

Rem Koolhaas and Ole Scheeren, OMA, New Headquarters, Central Chinese Television (CCTV), Beijing, ...

Rem Koolhaas and Ole Scheeren, OMA, New Headquarters, Central Chinese Television (CCTV), Beijing, ...