|

|

|

Drugs are in development that may cure asthma and hay fever once and for all. They target leukotrienes, which are known to cause tightening of the air passages in the lungs and increase mucus productions in nasal passages.

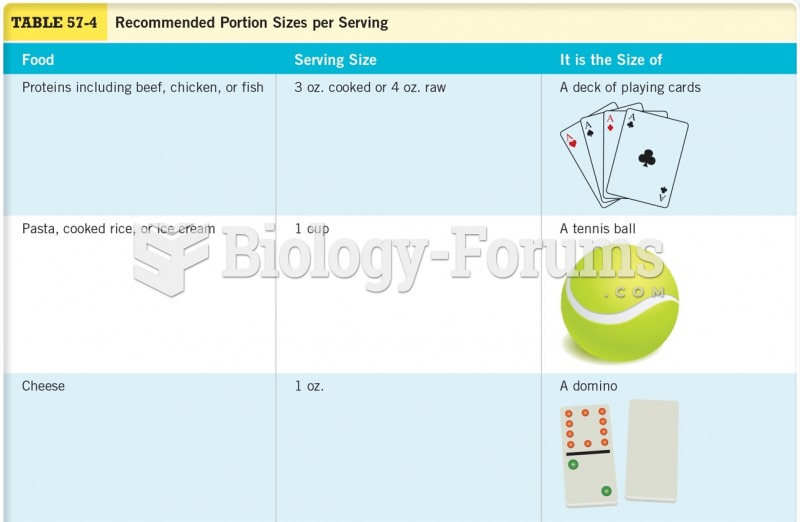

When taking monoamine oxidase inhibitors, people should avoid a variety of foods, which include alcoholic beverages, bean curd, broad (fava) bean pods, cheese, fish, ginseng, protein extracts, meat, sauerkraut, shrimp paste, soups, and yeast.

Though methadone is often used to treat dependency on other opioids, the drug itself can be abused. Crushing or snorting methadone can achieve the opiate "rush" desired by addicts. Improper use such as these can lead to a dangerous dependency on methadone. This drug now accounts for nearly one-third of opioid-related deaths.

The average person is easily confused by the terms pharmaceutics and pharmacology, thinking they are one and the same. Whereas pharmaceutics is the science of preparing and dispensing drugs (otherwise known as the science of pharmacy), pharmacology is the study of medications.

Asthma occurs in one in 11 children and in one in 12 adults. African Americans and Latinos have a higher risk for developing asthma than other groups.