|

|

|

The oldest recorded age was 122. Madame Jeanne Calment was born in France in 1875 and died in 1997. She was a vegetarian and loved olive oil, port wine, and chocolate.

Over time, chronic hepatitis B virus and hepatitis C virus infections can progress to advanced liver disease, liver failure, and hepatocellular carcinoma. Unlike other forms, more than 80% of hepatitis C infections become chronic and lead to liver disease. When combined with hepatitis B, hepatitis C now accounts for 75% percent of all cases of liver disease around the world. Liver failure caused by hepatitis C is now leading cause of liver transplants in the United States.

People often find it difficult to accept the idea that bacteria can be beneficial and improve health. Lactic acid bacteria are good, and when eaten, these bacteria improve health and increase longevity. These bacteria included in foods such as yogurt.

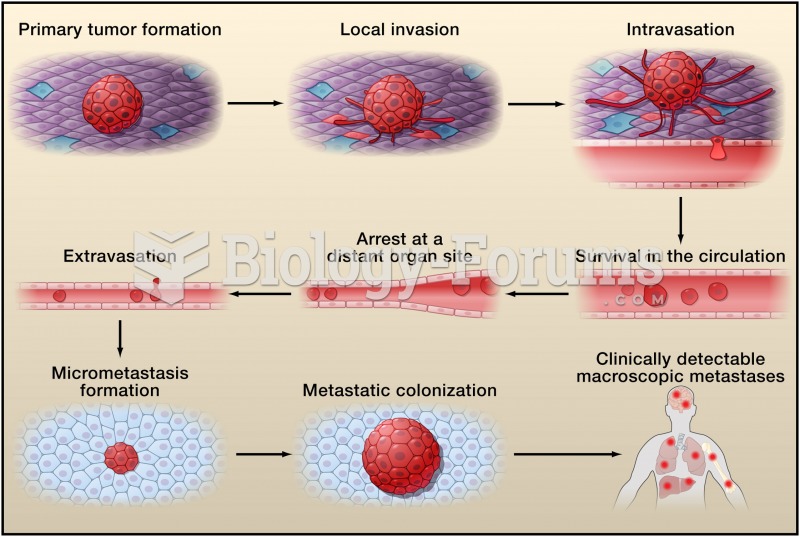

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.