|

|

|

Never take aspirin without food because it is likely to irritate your stomach. Never give aspirin to children under age 12. Overdoses of aspirin have the potential to cause deafness.

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

People who have myopia, or nearsightedness, are not able to see objects at a distance but only up close. It occurs when the cornea is either curved too steeply, the eye is too long, or both. This condition is progressive and worsens with time. More than 100 million people in the United States are nearsighted, but only 20% of those are born with the condition. Diet, eye exercise, drug therapy, and corrective lenses can all help manage nearsightedness.

Disorders that may affect pharmacodynamics include genetic mutations, malnutrition, thyrotoxicosis, myasthenia gravis, Parkinson's disease, and certain forms of insulin-resistant diabetes mellitus.

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

Booker T. Washington in his office at Tuskegee Institute, 1900. Washington chose a policy of accommo

Booker T. Washington in his office at Tuskegee Institute, 1900. Washington chose a policy of accommo

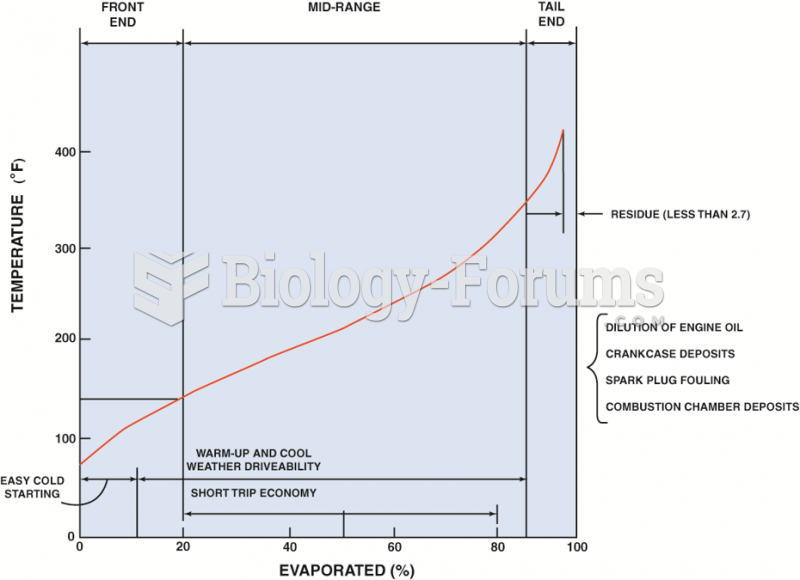

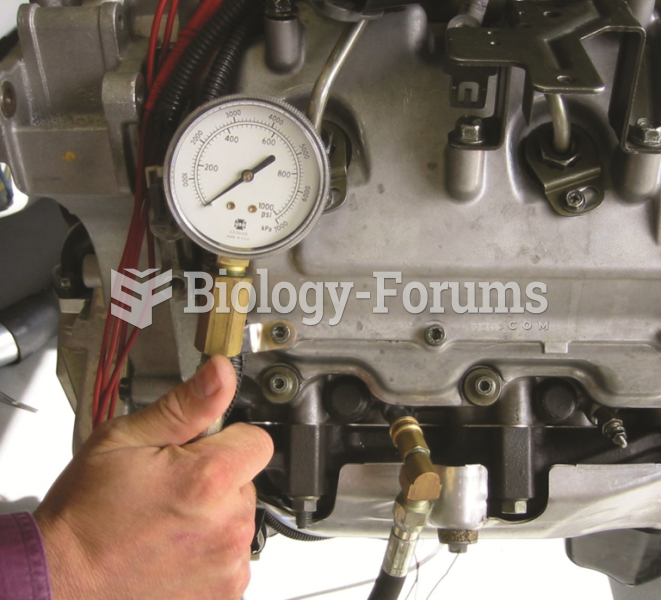

A compression gauge designed for the higher compression rate of a diesel engine should be used when ...

A compression gauge designed for the higher compression rate of a diesel engine should be used when ...