|

|

|

The use of salicylates dates back 2,500 years to Hippocrates's recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Vital signs (blood pressure, temperature, pulse rate, respiration rate) should be taken before any drug administration. Patients should be informed not to use tobacco or caffeine at least 30 minutes before their appointment.

Eating carrots will improve your eyesight. Carrots are high in vitamin A (retinol), which is essential for good vision. It can also be found in milk, cheese, egg yolks, and liver.

In inpatient settings, adverse drug events account for an estimated one in three of all hospital adverse events. They affect approximately 2 million hospital stays every year, and prolong hospital stays by between one and five days.

Intradermal injections are somewhat difficult to correctly administer because the skin layers are so thin that it is easy to accidentally punch through to the deeper subcutaneous layer.

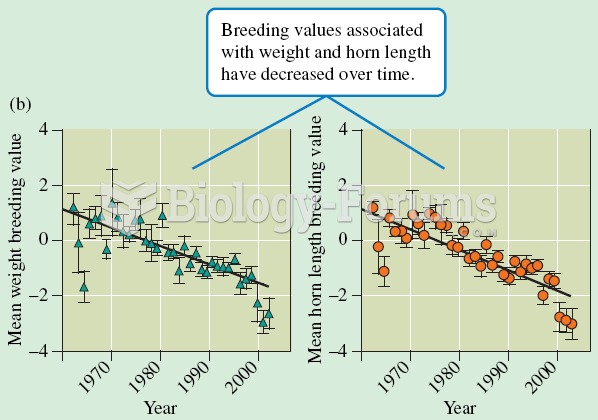

(a) Longevity decreases with increased horn-length breeding value of harvested rams. (b) Mean-weight

(a) Longevity decreases with increased horn-length breeding value of harvested rams. (b) Mean-weight

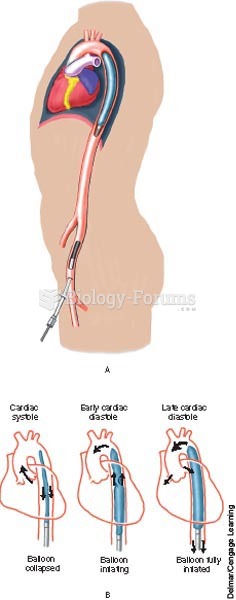

An intra-aortic balloon pump increases circulation to the coronary arteries and decreases the worklo

An intra-aortic balloon pump increases circulation to the coronary arteries and decreases the worklo

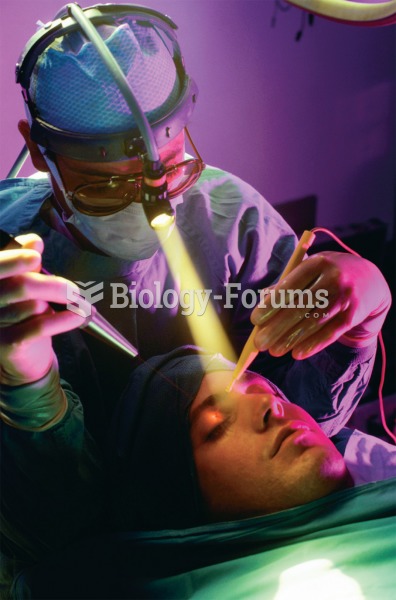

Rhytidoplasty. This is a common form of plastic surgery in which the skin is pulled and sutured to d

Rhytidoplasty. This is a common form of plastic surgery in which the skin is pulled and sutured to d