This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Essential fatty acids have been shown to be effective against ulcers, asthma, dental cavities, and skin disorders such as acne.

Did you know?

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

Did you know?

For pediatric patients, intravenous fluids are the most commonly cited products involved in medication errors that are reported to the USP.

Did you know?

The U.S. Preventive Services Task Force recommends that all women age 65 years of age or older should be screened with bone densitometry.

Did you know?

According to the CDC, approximately 31.7% of the U.S. population has high low-density lipoprotein (LDL) or "bad cholesterol" levels.

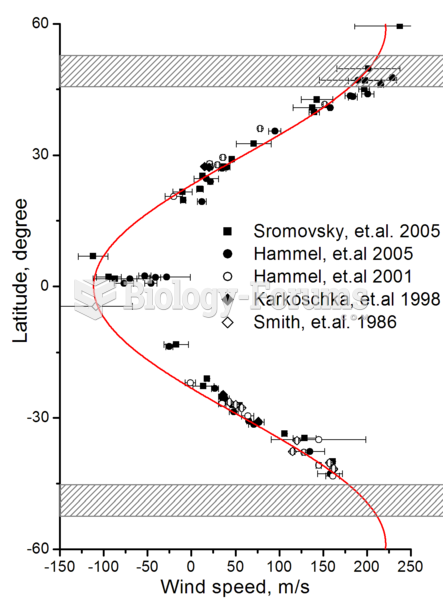

Zonal wind speeds on Uranus. Shaded areas show the southern collar and its future northern counterpa

Zonal wind speeds on Uranus. Shaded areas show the southern collar and its future northern counterpa

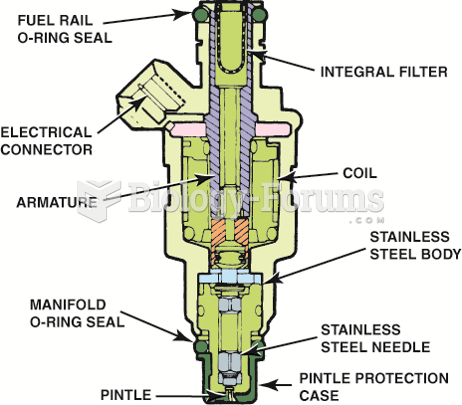

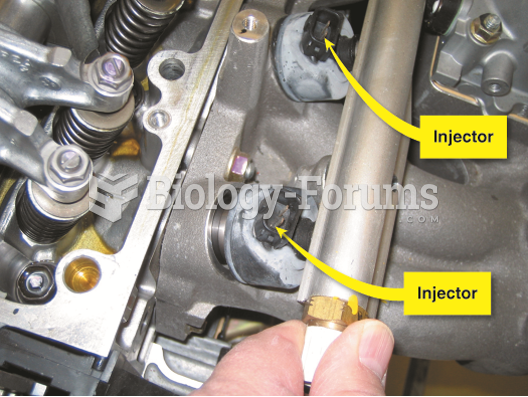

The fuel injectors used on this Honda Civic GX CNG engine are designed to flow gaseous fuel instead ...

The fuel injectors used on this Honda Civic GX CNG engine are designed to flow gaseous fuel instead ...

A fuel system tester connected in series in the fuel system so all of the fuel used flows through ...

A fuel system tester connected in series in the fuel system so all of the fuel used flows through ...