Answer to Question 1

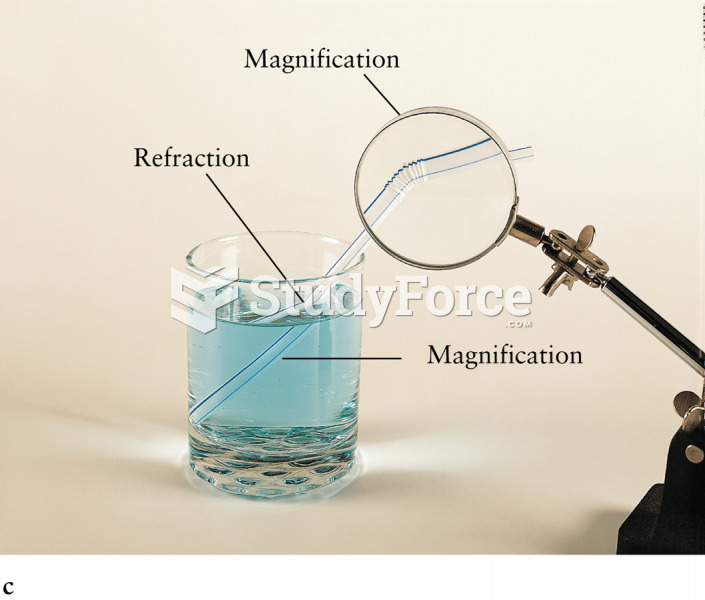

c

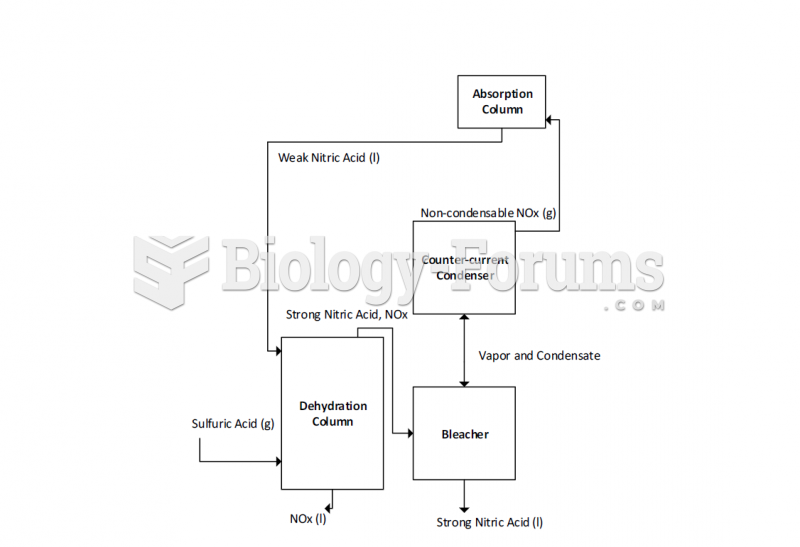

Answer to Question 2

Only in the tiniest businesses do we encounter someone who is simultaneously a hands-on

boss, a provider of capital, and a residual claimant. A doctor in solo practice or the owner of a small store may take on all these duties because it is too costly to hire specialists. For more sizable organizations, however, the principles of division of labor and efficient risk bearing also apply to ownership, investment, and management. Let us examine separation of the management function from those of finance and residual claimancy.

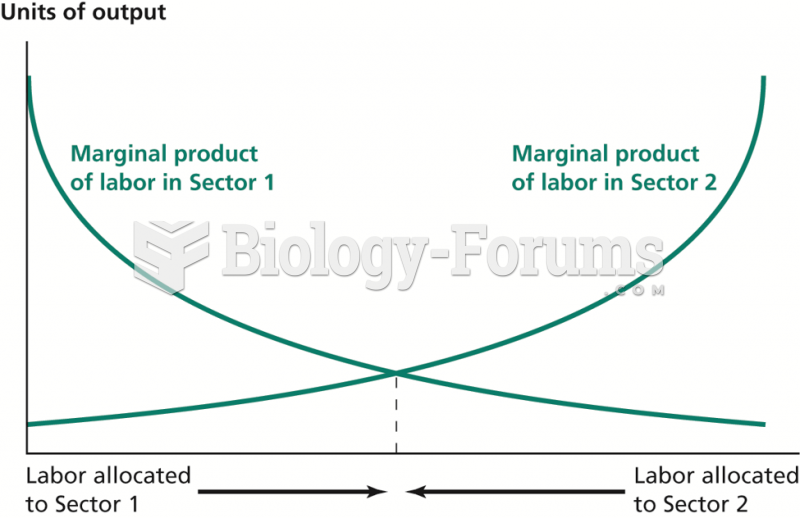

Different skills and opportunity costs: Limits on a manager's knowledge and capabilities may make her a poor candidate for residual claimant. Training in management entails psychological and organizational skills, while training in finance requires very different specialized knowledge. If a single person handles both functions, more time spent supervising operations means less time to spend exploring the organization's financial choices.

Risk and diversification: Residual claimants who have interests in more than one firm are diversified in ways that managers who depend on a single employer for most of their incomes cannot be. If so, risk-averse managers may make safer choices for the business than its residual claimant(s) would prefer. It is possible to dampen this potential conflict by rewarding top managers with a mix of a fixed salary and pay that depends on the firm's performance.

Ownership and control: Residual claimants ultimately choose a firm's managers. They often prefer to be passive and allow managers to make executive decisions in all but exceptional situations. A diversified residual claimant generally has less understanding of the firm than a manager and has little knowledge that is likely to improve the quality of the manager's choices. The separation of corporate ownership (shareholders are residual claimants) and control (management) removes most executive decisions from shareholder scrutiny, but this may be an efficient division of labor between persons with differing skills, goals, and wealth.