|

|

|

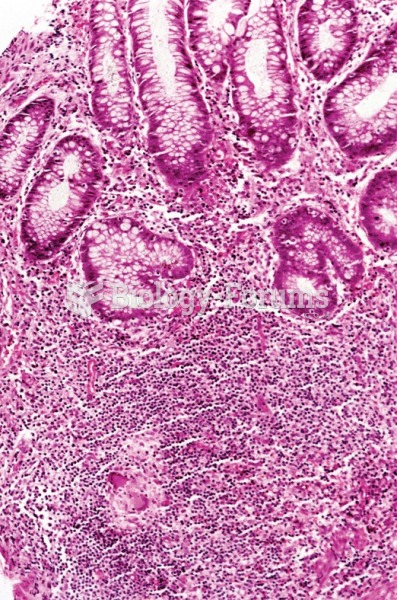

To prove that stomach ulcers were caused by bacteria and not by stress, a researcher consumed an entire laboratory beaker full of bacterial culture. After this, he did indeed develop stomach ulcers, and won the Nobel Prize for his discovery.

Immunoglobulin injections may give short-term protection against, or reduce severity of certain diseases. They help people who have an inherited problem making their own antibodies, or those who are having certain types of cancer treatments.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

After a vasectomy, it takes about 12 ejaculations to clear out sperm that were already beyond the blocked area.

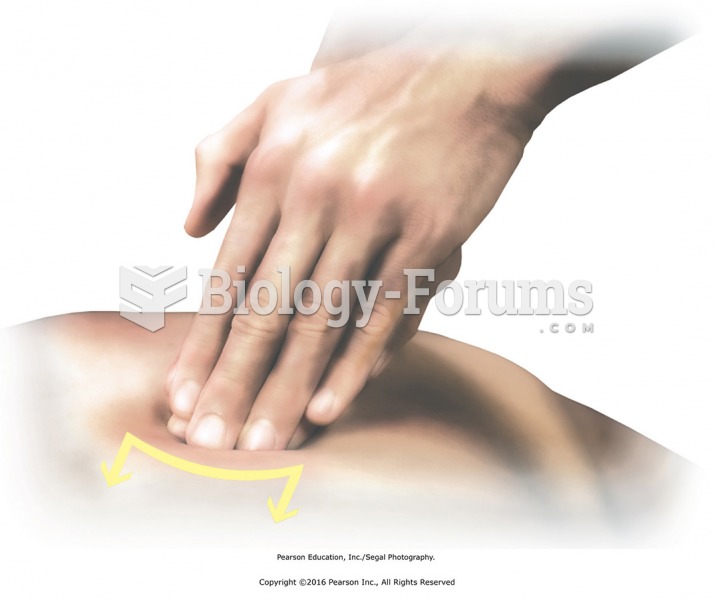

Oxytocin is recommended only for pregnancies that have a medical reason for inducing labor (such as eclampsia) and is not recommended for elective procedures or for making the birthing process more convenient.