Answer to Question 1

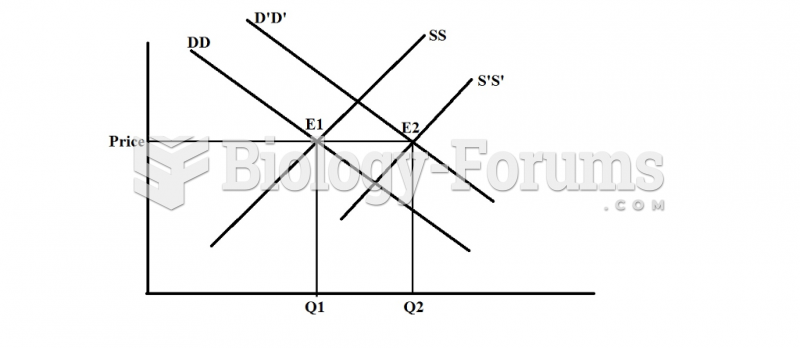

In the model of adverse selection, the seller cannot obtain reliable information from a number of buyers. Incentives to withhold or falsify facts can affect market equilibrium. As an example, assume that health insurers are unable to determine a person's underlying healthiness before writing a policy. Assume there are two types of policy. Comprehensive ones cover a wide range of treatments and have high limits on hospitalization costs. By contrast, a health maintenance organization (HMO) policy reimburses fewer treatments and has inferior cost coverage. Not surprisingly, the comprehensive plan must charge more than the HMO to survive. If enrollees in both plans are random samples of the population, each policy's premium can be set so that it breaks even. An insurer that does not know a person's riskiness will set rates as if its customers are typical of the population. Adverse selection means the population does not choose at random between the plans. A motorcycle racer who is likely to have an accident that will generate large medical bills will probably prefer fuller coverage than a stamp collector, other things equal. The motorcycle racer will choose the comprehensive plan, and the stamp collector will choose the HMO.

Moral hazard, on the other hand, is an insured person's incentive to behave in ways that raise the probability of a claim. Here moral is not a normative conceptcomprehensiv e health insurance can encourage more frequent visits to the doctor that many people would view as prudent. Policyholders with full coverage for all medical services bear only the opportunity costs of time spent obtaining them. If a doctor suggests a costly test to detect a rare condition, you might choose not to spend your own funds but will submit to it if your insurer is paying. Taking moral hazard a step further, giving the test might increase the doctor's income. Insurers understand this principal/agent problem and may require the doctor to submit information about you before they approve reimbursement for it. (They can also perform audits and order refunds.) Insurance can also affect the patient's choice to seek care. A runny nose that will soon go away might still be worth a doctor visit if insurance allows you to recover its cost. Insurers also reduce moral hazard by limiting coverage of open-ended (and for some, enjoyable) treatments like psychotherapy. Fully elective treatments like nose jobs are seldom covered.

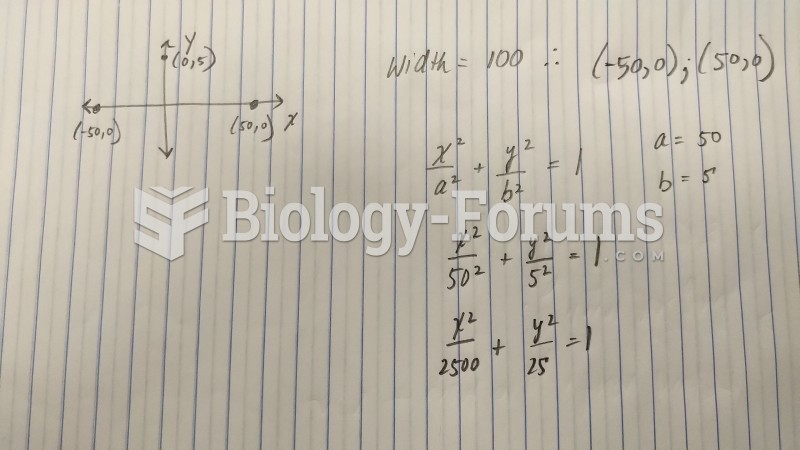

Answer to Question 2

A