|

|

|

Did you know?

The immune system needs 9.5 hours of sleep in total darkness to recharge completely.

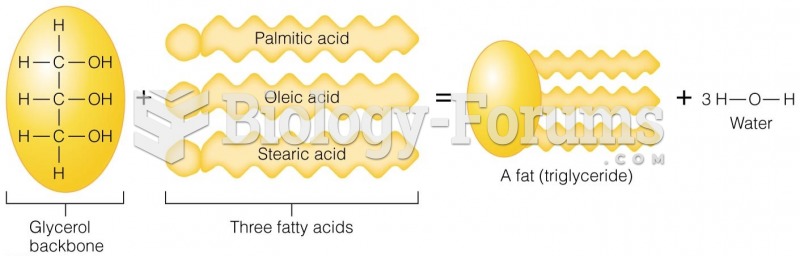

Did you know?

Essential fatty acids have been shown to be effective against ulcers, asthma, dental cavities, and skin disorders such as acne.

Did you know?

Egg cells are about the size of a grain of sand. They are formed inside of a female's ovaries before she is even born.

Did you know?

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

Did you know?

The first monoclonal antibodies were made exclusively from mouse cells. Some are now fully human, which means they are likely to be safer and may be more effective than older monoclonal antibodies.