|

|

|

Did you know?

According to the CDC, approximately 31.7% of the U.S. population has high low-density lipoprotein (LDL) or "bad cholesterol" levels.

Did you know?

Approximately one in three babies in the United States is now delivered by cesarean section. The number of cesarean sections in the United States has risen 46% since 1996.

Did you know?

Excessive alcohol use costs the country approximately $235 billion every year.

Did you know?

Barbituric acid, the base material of barbiturates, was first synthesized in 1863 by Adolph von Bayer. His company later went on to synthesize aspirin for the first time, and Bayer aspirin is still a popular brand today.

Did you know?

About 3% of all pregnant women will give birth to twins, which is an increase in rate of nearly 60% since the early 1980s.

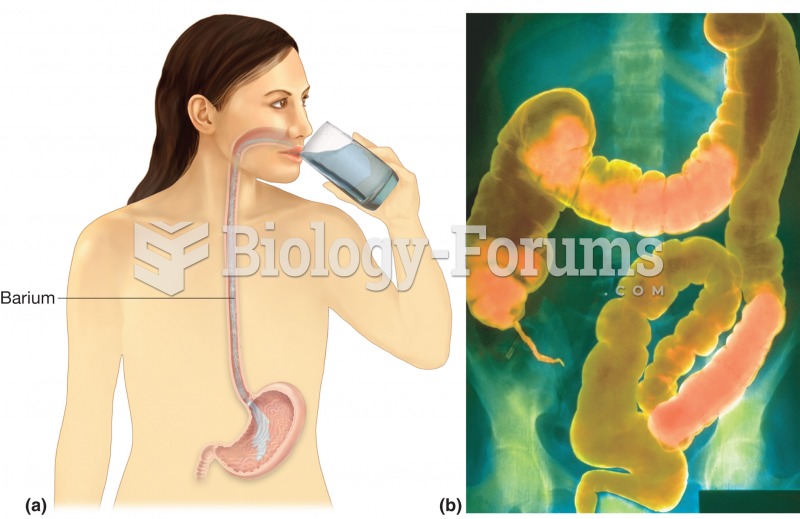

GI series. (a) Upper GI series begins with a barium swallow, barium shake, or barium meal. (b) Lower

GI series. (a) Upper GI series begins with a barium swallow, barium shake, or barium meal. (b) Lower

In 2008, the U.S. economy suffered a gaping wound as several trillion dollars were ripped out of it.

In 2008, the U.S. economy suffered a gaping wound as several trillion dollars were ripped out of it.