|

|

|

The first monoclonal antibodies were made exclusively from mouse cells. Some are now fully human, which means they are likely to be safer and may be more effective than older monoclonal antibodies.

Not getting enough sleep can greatly weaken the immune system. Lack of sleep makes you more likely to catch a cold, or more difficult to fight off an infection.

Vampire bats have a natural anticoagulant in their saliva that permits continuous bleeding after they painlessly open a wound with their incisors. This capillary blood does not cause any significant blood loss to their victims.

Alzheimer's disease affects only about 10% of people older than 65 years of age. Most forms of decreased mental function and dementia are caused by disuse (letting the mind get lazy).

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

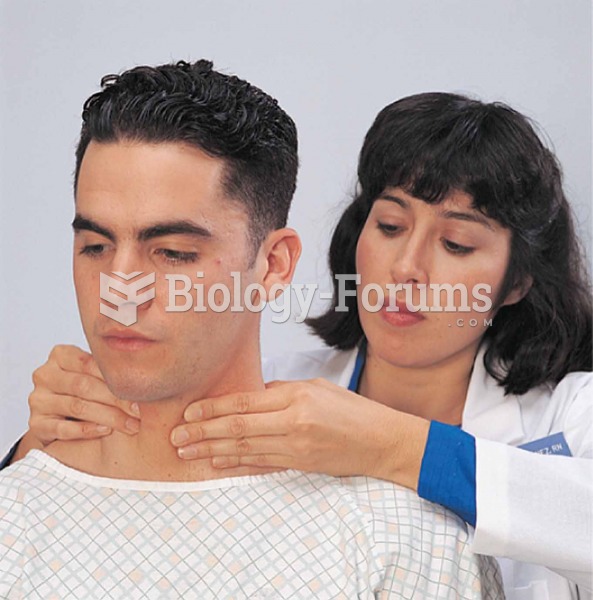

Palpating the thyroid gland from behind the patient is a most effective way of assessing the gland f

Palpating the thyroid gland from behind the patient is a most effective way of assessing the gland f

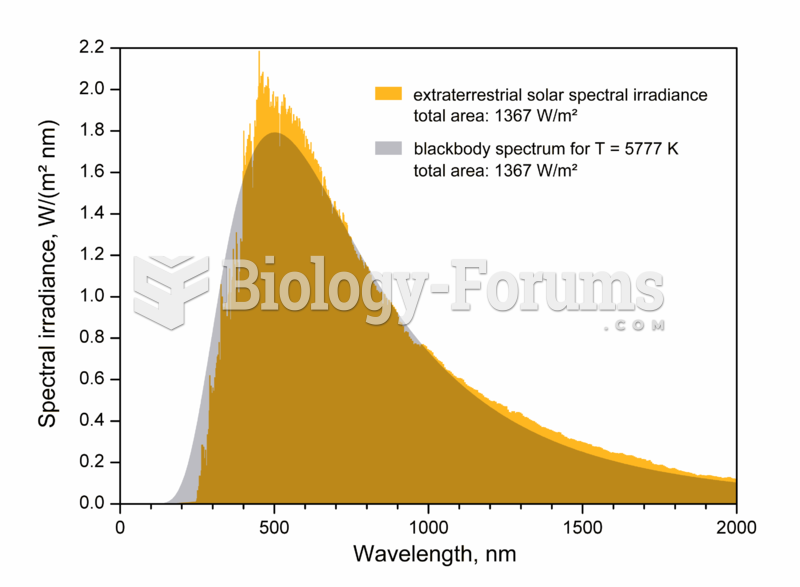

The effective temperature, or black body temperature, of the Sun (5777 K) is the temperature a black

The effective temperature, or black body temperature, of the Sun (5777 K) is the temperature a black