As part of the most recent collective bargaining agreement with state employees, a state government must offer dental insurance at reasonable, nonprofit rates. The state plans to self insure in place of using a private insurance company.

Statistical evidence suggests that the average household currently spends 300 per year for corrective dental work and 80 for routine checkups. Administrative costs are expected to average 20 per family. The collective bargaining agreement dictates that the plan's coverages and rates be fixed for a period of three years. The auditor considers the choice of the plan to be extremely important. Consequently, the auditor has asked you to evaluate the three proposals listed below in terms of their propensity to result in adverse selection and/or moral hazard. Proposal 1 would charge a 400 premium with no deductible. Coverage is extended to preexisting conditions, but to cover the nondeductible clause, routine checkups are not covered. Proposal 2 charges a 200 premium with a 200 deductible. The plan does not cover preexisting conditions, but does cover routine office visits. Proposal 3 charges a 150 premium with a 150 deductible. This plan doesn't cover preexisting conditions or routine checkups. The collective bargaining agreement dictates that participation in the plan must be at the employee's option.

Question 2

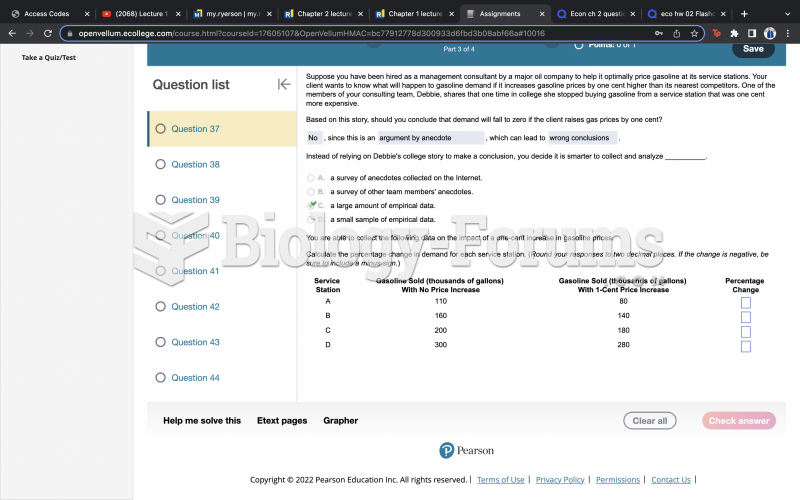

The price of video cassette recorders (VCRs) remains constant, but the market demand curve for VCRs shifts leftward as consumers shift to DVDs and other video technologies.

What happens to the consumer surplus in this market as the demand curve shifts? A) Increases

B) Decreases

C) Remains the same

D) We do not have enough information to answer this question.