|

|

|

Did you know?

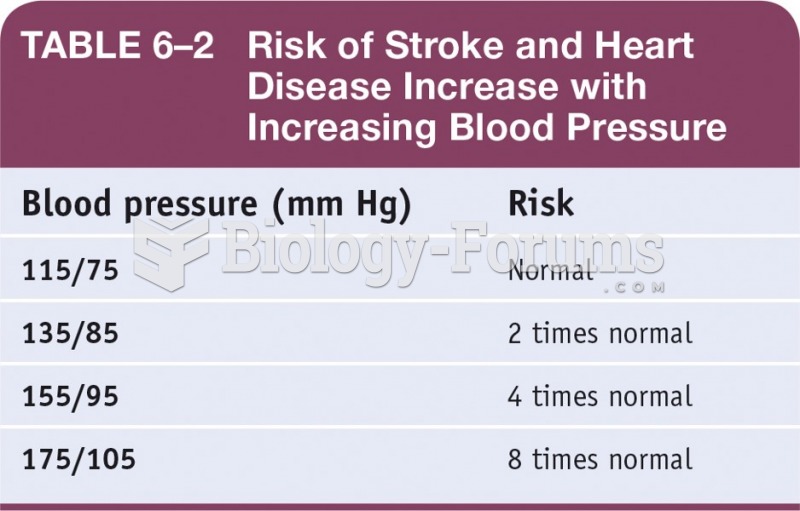

People with high total cholesterol have about two times the risk for heart disease as people with ideal levels.

Did you know?

HIV testing reach is still limited. An estimated 40% of people with HIV (more than 14 million) remain undiagnosed and do not know their infection status.

Did you know?

Complications of influenza include: bacterial pneumonia, ear and sinus infections, dehydration, and worsening of chronic conditions such as asthma, congestive heart failure, or diabetes.

Did you know?

The word drug comes from the Dutch word droog (meaning "dry"). For centuries, most drugs came from dried plants, hence the name.

Did you know?

The Romans did not use numerals to indicate fractions but instead used words to indicate parts of a whole.