|

|

|

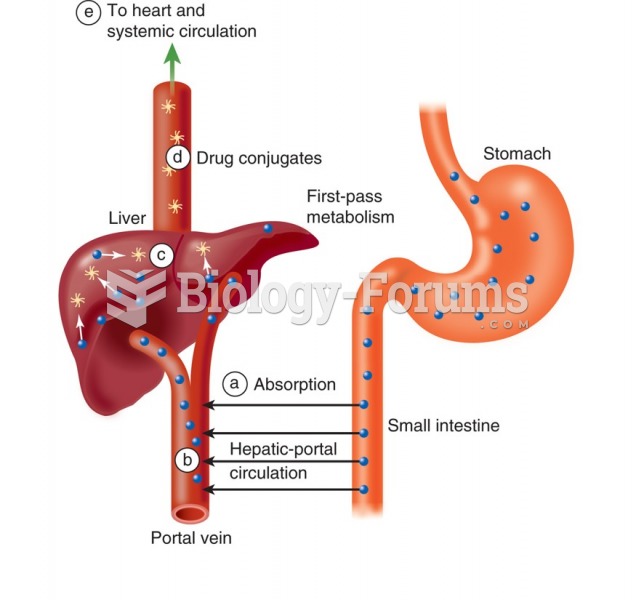

The word drug comes from the Dutch word droog (meaning "dry"). For centuries, most drugs came from dried plants, hence the name.

Many of the drugs used by neuroscientists are derived from toxic plants and venomous animals (such as snakes, spiders, snails, and puffer fish).

There are more sensory neurons in the tongue than in any other part of the body.

Most strokes are caused when blood clots move to a blood vessel in the brain and block blood flow to that area. Thrombolytic therapy can be used to dissolve the clot quickly. If given within 3 hours of the first stroke symptoms, this therapy can help limit stroke damage and disability.

Addicts to opiates often avoid treatment because they are afraid of withdrawal. Though unpleasant, with proper management, withdrawal is rarely fatal and passes relatively quickly.