|

|

|

Always store hazardous household chemicals in their original containers out of reach of children. These include bleach, paint, strippers and products containing turpentine, garden chemicals, oven cleaners, fondue fuels, nail polish, and nail polish remover.

More than nineteen million Americans carry the factor V gene that causes blood clots, pulmonary embolism, and heart disease.

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

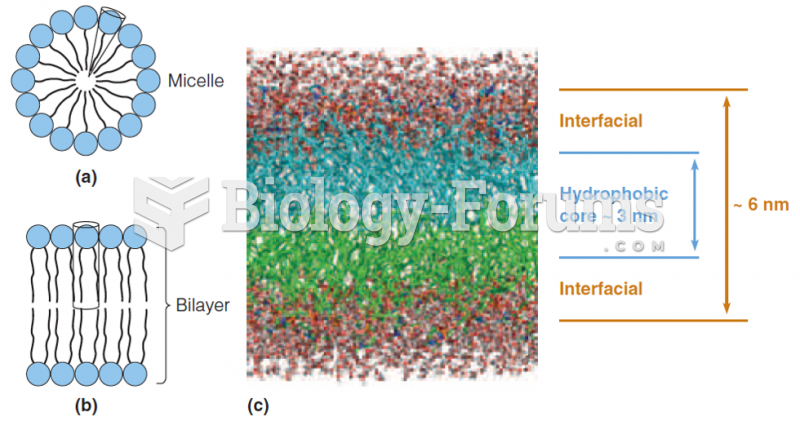

A good example of polar molecules can be understood when trying to make a cake. If water and oil are required, they will not mix together. If you put them into a measuring cup, the oil will rise to the top while the water remains on the bottom.

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.