|

|

|

Did you know?

Fewer than 10% of babies are born on their exact due dates, 50% are born within 1 week of the due date, and 90% are born within 2 weeks of the date.

Did you know?

According to the Migraine Research Foundation, migraines are the third most prevalent illness in the world. Women are most affected (18%), followed by children of both sexes (10%), and men (6%).

Did you know?

HIV testing reach is still limited. An estimated 40% of people with HIV (more than 14 million) remain undiagnosed and do not know their infection status.

Did you know?

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

Did you know?

Urine turns bright yellow if larger than normal amounts of certain substances are consumed; one of these substances is asparagus.

In 2009, historian Woody Holton described how Abigail Adams shrewdly invested in the Continental Con

In 2009, historian Woody Holton described how Abigail Adams shrewdly invested in the Continental Con

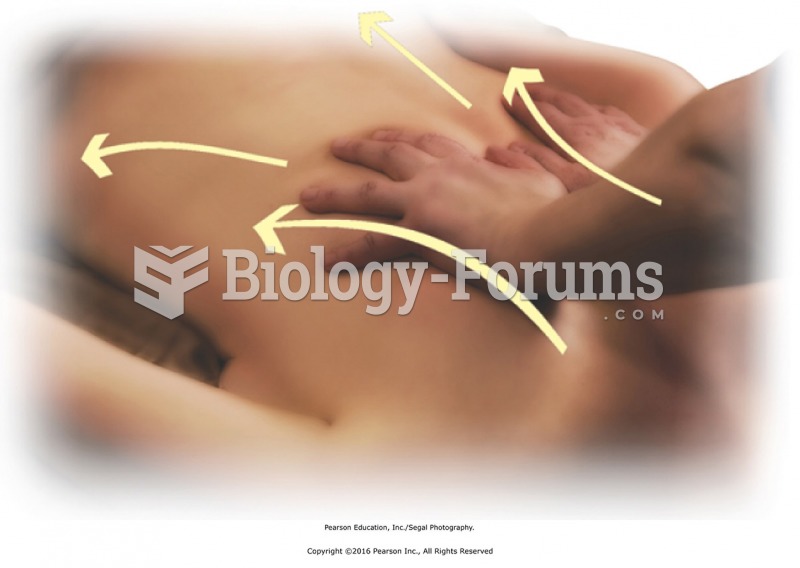

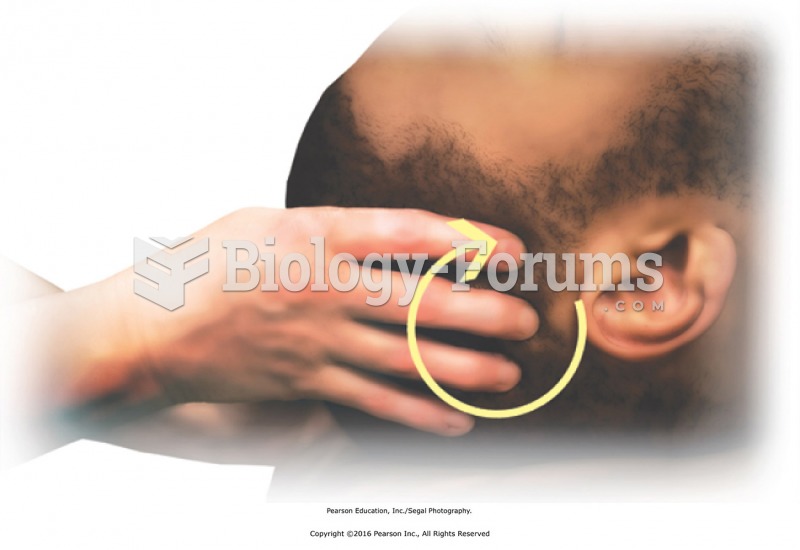

Loosen the scalp by applying circular friction to the sides, back, and top of head (over entire hair ...

Loosen the scalp by applying circular friction to the sides, back, and top of head (over entire hair ...