|

|

|

Approximately 70% of expectant mothers report experiencing some symptoms of morning sickness during the first trimester of pregnancy.

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Drying your hands with a paper towel will reduce the bacterial count on your hands by 45–60%.

Colchicine is a highly poisonous alkaloid originally extracted from a type of saffron plant that is used mainly to treat gout.

Sperm cells are so tiny that 400 to 500 million (400,000,000–500,000,000) of them fit onto 1 tsp.

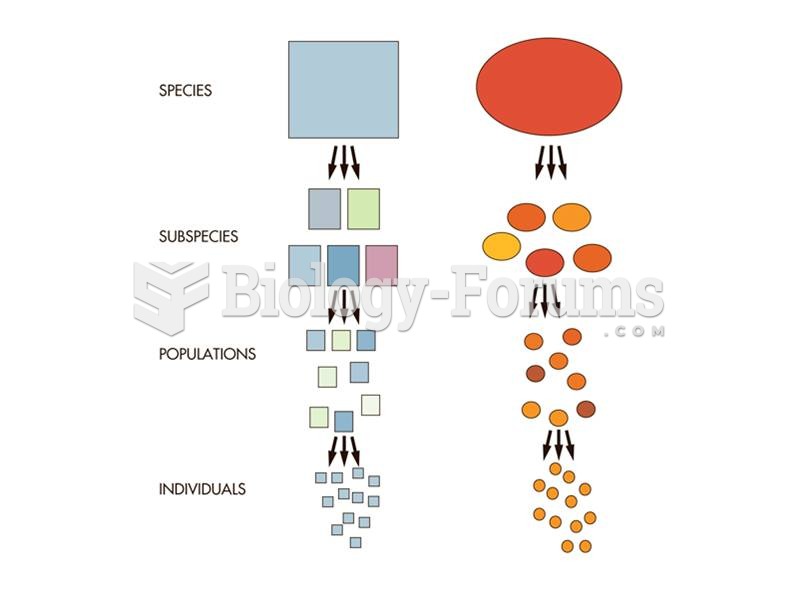

Male individuals of the banded Uromastyx, Uromastyx flavofasciata, are different colours. Most natur

Male individuals of the banded Uromastyx, Uromastyx flavofasciata, are different colours. Most natur

Vertebral compression Fractures of the spine (vertebra) can cause severe ”band-like” pain that radia

Vertebral compression Fractures of the spine (vertebra) can cause severe ”band-like” pain that radia