This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

About 600,000 particles of skin are shed every hour by each human. If you live to age 70 years, you have shed 105 pounds of dead skin.

Did you know?

There are more sensory neurons in the tongue than in any other part of the body.

Did you know?

There are over 65,000 known species of protozoa. About 10,000 species are parasitic.

Did you know?

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

Did you know?

In the ancient and medieval periods, dysentery killed about ? of all babies before they reach 12 months of age. The disease was transferred through contaminated drinking water, because there was no way to adequately dispose of sewage, which contaminated the water.

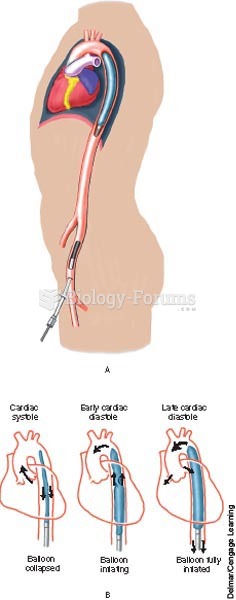

An intra-aortic balloon pump increases circulation to the coronary arteries and decreases the worklo

An intra-aortic balloon pump increases circulation to the coronary arteries and decreases the worklo

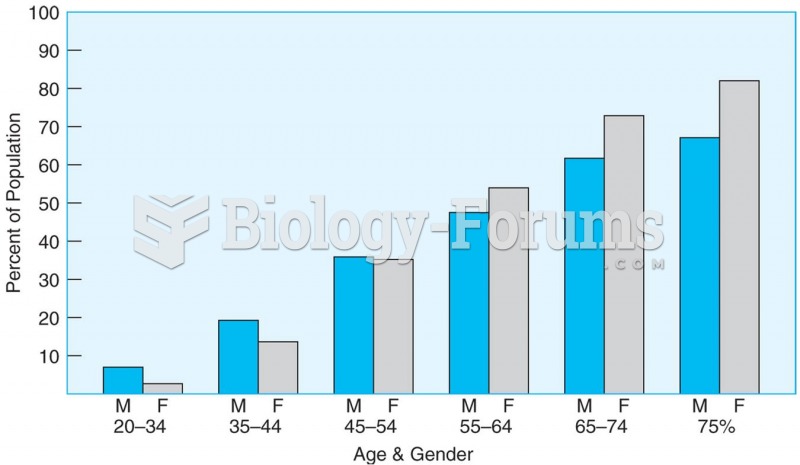

The proportion of men and women with elevated blood pressure or taking hypertension medication incre

The proportion of men and women with elevated blood pressure or taking hypertension medication incre