|

|

|

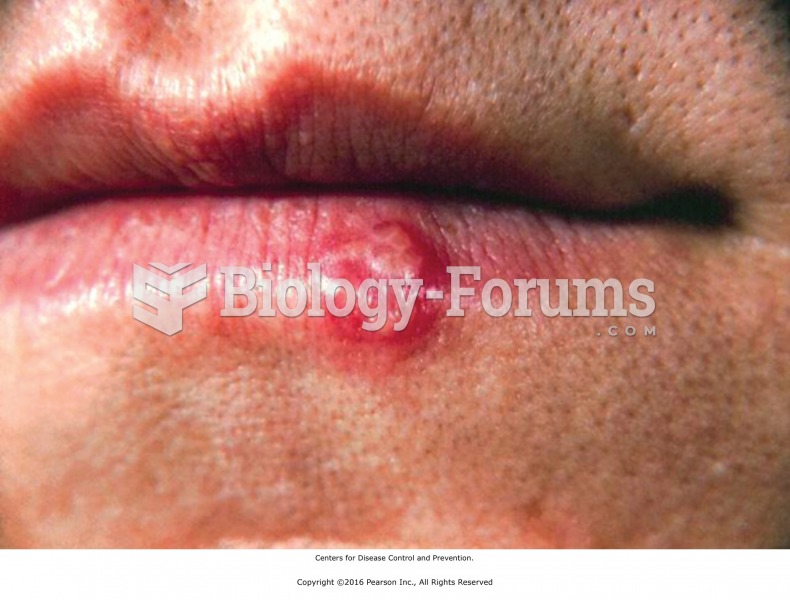

Methicillin-resistant Staphylococcus aureus or MRSA was discovered in 1961 in the United Kingdom. It if often referred to as a superbug. MRSA infections cause more deaths in the United States every year than AIDS.

Intradermal injections are somewhat difficult to correctly administer because the skin layers are so thin that it is easy to accidentally punch through to the deeper subcutaneous layer.

Despite claims by manufacturers, the supplement known as Ginkgo biloba was shown in a study of more than 3,000 participants to be ineffective in reducing development of dementia and Alzheimer’s disease in older people.

In 2006, a generic antinausea drug named ondansetron was approved. It is used to stop nausea and vomiting associated with surgery, chemotherapy, and radiation therapy.

This year, an estimated 1.4 million Americans will have a new or recurrent heart attack.