|

|

|

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

If all the neurons in the human body were lined up, they would stretch more than 600 miles.

Many medications that are used to treat infertility are injected subcutaneously. This is easy to do using the anterior abdomen as the site of injection but avoiding the area directly around the belly button.

Methicillin-resistant Staphylococcus aureus or MRSA was discovered in 1961 in the United Kingdom. It if often referred to as a superbug. MRSA infections cause more deaths in the United States every year than AIDS.

Although puberty usually occurs in the early teenage years, the world's youngest parents were two Chinese children who had their first baby when they were 8 and 9 years of age.

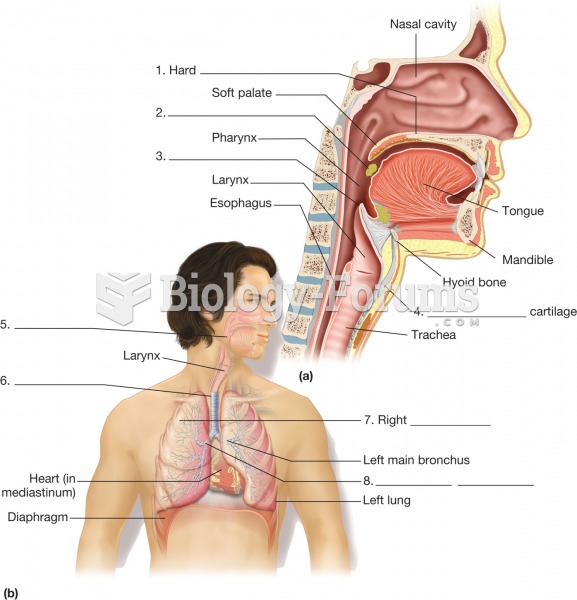

The respiratory system. (a) Sagittal section of the head and neck, revealing the organs of the upper

The respiratory system. (a) Sagittal section of the head and neck, revealing the organs of the upper

Bones do not allow the X-ray beam to pass through them, resulting in an image of the bones on the ...

Bones do not allow the X-ray beam to pass through them, resulting in an image of the bones on the ...