Answer to Question 1

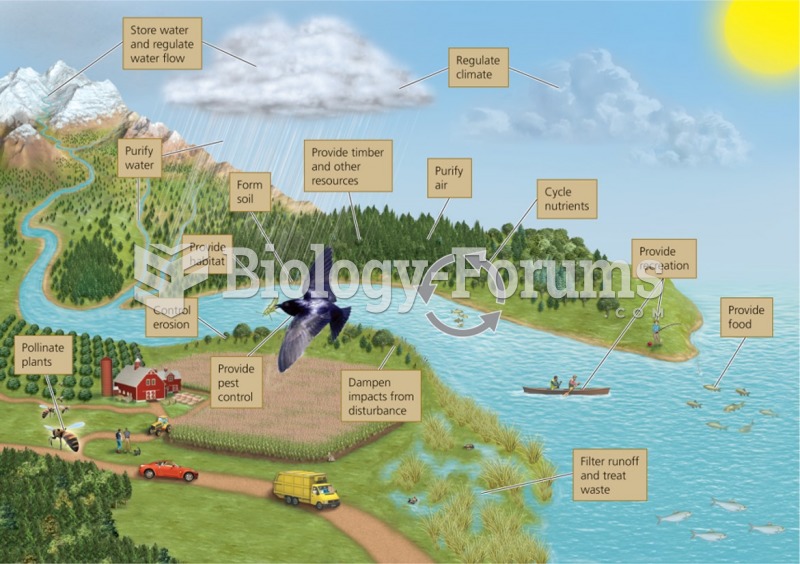

The primary services provided by employee assistance programs (EAPs) are alcohol and drug abuse counseling, counseling for emotional difficulties, family counseling, career counseling and education, credit counseling, and retirement planning.

Career counseling and education: EAPs have become involved in two areas of career counseling: helping employees to set and achieve specific career goals and helping them to learn and use stress management techniques. In the first area, EAPs may administer, or arrange for, aptitude tests. They may also help employees to understand the promotion and advancement opportunities within the company. EAPs help employees to enroll in educational programs that enhance their physical and mental health and increase their skills on the job. EAPs also provide, or arrange for, workshops and seminars on stress management techniques. Such techniques include using relaxation exercises, hypnosis, time management, or positive thinking; developing hobbies and exercise programs; improving interpersonal relationships; learning to solve problems; and establishing a positive sense of self. Employees who are experiencing burnout or severe job stress may receive counseling by EAP staff or be referred elsewhere for therapy.

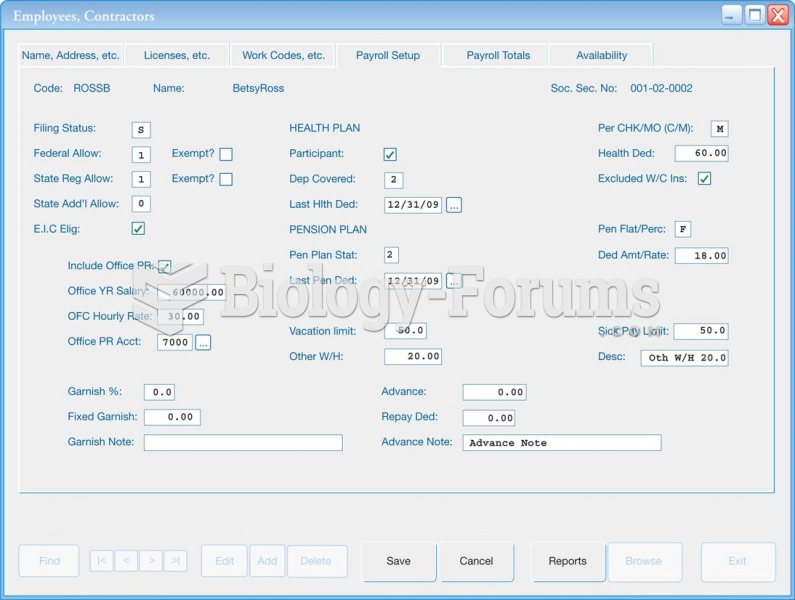

Credit counseling: Many EAPs have become involved in providing assistance to employees who are having financial difficulties and need credit counseling. One aspect of this involves debt counseling, in which the workers receive assistance in renegotiating their payments to creditors over a longer period of time. They are also encouraged to make a commitment to defer further credit purchases until the financial burden is reduced. Often, they also receive financial counseling on developing a budget to meet their financial needs. In some states, creditors can claim part of the debtor's wages through legal garnishment. EAP staff members may get involved in cases of legal garnishment to help employees straighten out their financial circumstances. Some EAPs also provide financial planning assistance to employees who are burdened with alimony and child support payments.

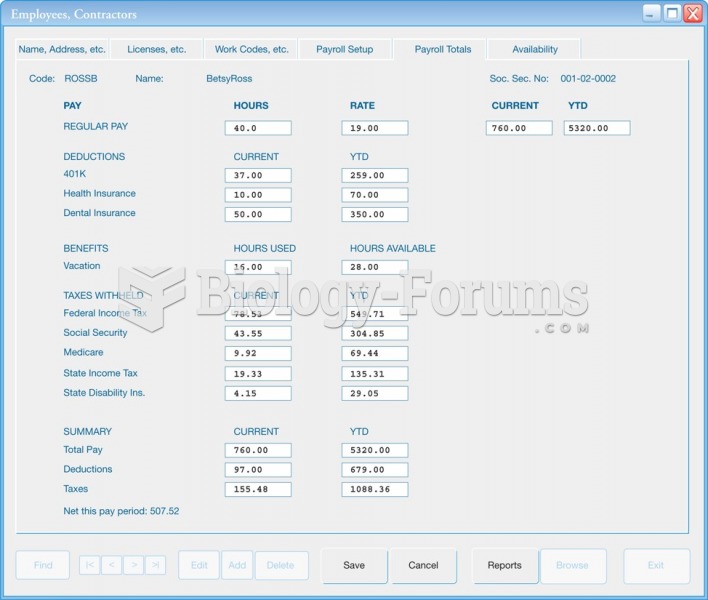

Retirement planning: In recent years, employees have shown increased interest in retirement planning. EAPs can arrange retirement-planning workshops and seminars for employees. A wide variety of programs can be explained, including Social Security benefits, individual retirement account (IRA) plans, pension plans, profit-sharing plans, stock option plans, and tax-sheltered annuity plans. EAP staff should be knowledgeable about the retirement plans available from the firm in order to help individuals make intelligent decisions. EAP staff may also provide assistance to employees nearing retirement. Such employees need to plan not only for their financial needs but also for what they will do to maintain a high level of positive mental and physical activity.

Answer to Question 2

False