|

|

|

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

There used to be a metric calendar, as well as metric clocks. The metric calendar, or "French Republican Calendar" divided the year into 12 months, but each month was divided into three 10-day weeks. Each day had 10 decimal hours. Each hour had 100 decimal minutes. Due to lack of popularity, the metric clocks and calendars were ended in 1795, three years after they had been first marketed.

Addicts to opiates often avoid treatment because they are afraid of withdrawal. Though unpleasant, with proper management, withdrawal is rarely fatal and passes relatively quickly.

Asthma-like symptoms were first recorded about 3,500 years ago in Egypt. The first manuscript specifically written about asthma was in the year 1190, describing a condition characterized by sudden breathlessness. The treatments listed in this manuscript include chicken soup, herbs, and sexual abstinence.

Less than one of every three adults with high LDL cholesterol has the condition under control. Only 48.1% with the condition are being treated for it.

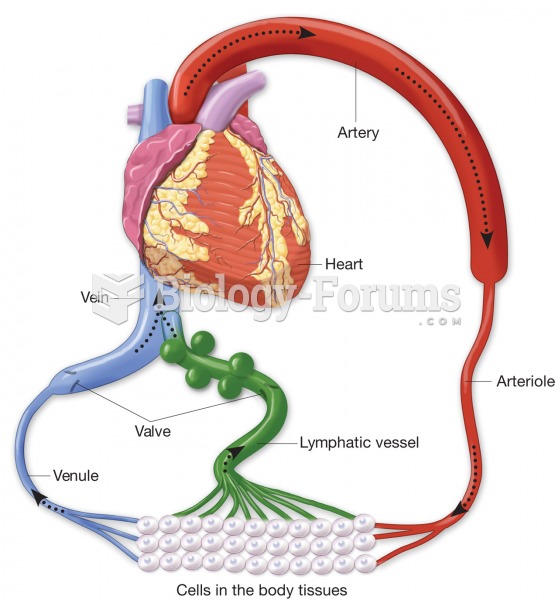

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

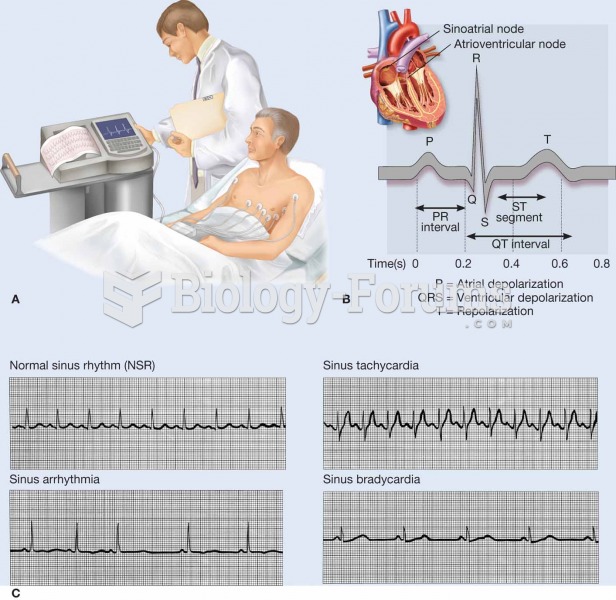

An electrocardiogram (ECG, EKG) is a commonly used procedure in which the electrical events associat

An electrocardiogram (ECG, EKG) is a commonly used procedure in which the electrical events associat