|

|

|

More than 2,500 barbiturates have been synthesized. At the height of their popularity, about 50 were marketed for human use.

The most common childhood diseases include croup, chickenpox, ear infections, flu, pneumonia, ringworm, respiratory syncytial virus, scabies, head lice, and asthma.

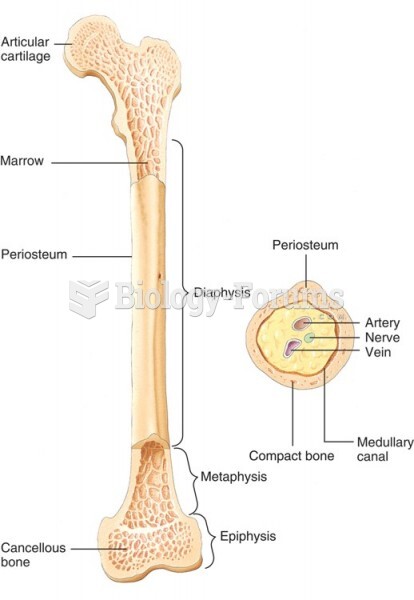

Hip fractures are the most serious consequences of osteoporosis. The incidence of hip fractures increases with each decade among patients in their 60s to patients in their 90s for both women and men of all populations. Men and women older than 80 years of age show the highest incidence of hip fractures.

Excessive alcohol use costs the country approximately $235 billion every year.

There used to be a metric calendar, as well as metric clocks. The metric calendar, or "French Republican Calendar" divided the year into 12 months, but each month was divided into three 10-day weeks. Each day had 10 decimal hours. Each hour had 100 decimal minutes. Due to lack of popularity, the metric clocks and calendars were ended in 1795, three years after they had been first marketed.