|

|

|

If you use artificial sweeteners, such as cyclamates, your eyes may be more sensitive to light. Other factors that will make your eyes more sensitive to light include use of antibiotics, oral contraceptives, hypertension medications, diuretics, and antidiabetic medications.

There are major differences in the metabolism of morphine and the illegal drug heroin. Morphine mostly produces its CNS effects through m-receptors, and at k- and d-receptors. Heroin has a slight affinity for opiate receptors. Most of its actions are due to metabolism to active metabolites (6-acetylmorphine, morphine, and morphine-6-glucuronide).

The strongest synthetic topical retinoid drug available, tazarotene, is used to treat sun-damaged skin, acne, and psoriasis.

There are over 65,000 known species of protozoa. About 10,000 species are parasitic.

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

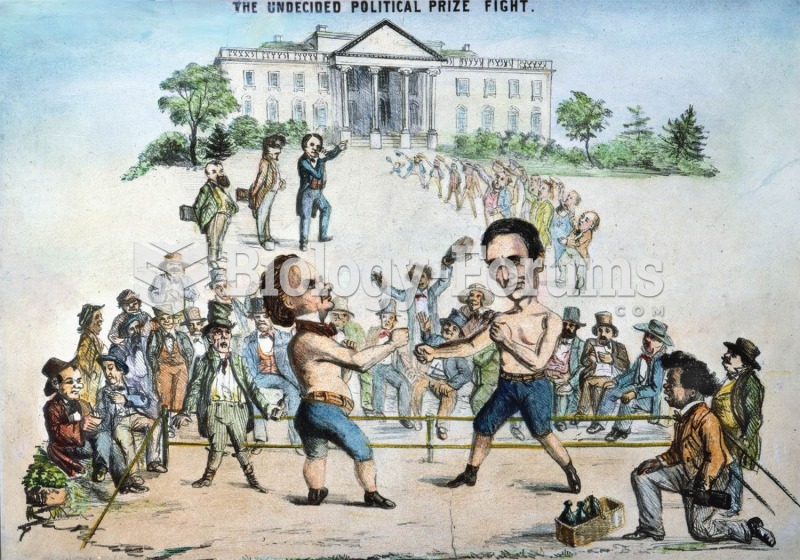

That politics was always a rough business is shown in this cartoon, which shows Lincoln, assisted by

That politics was always a rough business is shown in this cartoon, which shows Lincoln, assisted by

President-elect Barack Obama, his daughters, and wife, Michelle, celebrate his victory in November 2

President-elect Barack Obama, his daughters, and wife, Michelle, celebrate his victory in November 2

All of the homes in this new neighborhood of Brentwood, California, are for sale, evidence of the co

All of the homes in this new neighborhood of Brentwood, California, are for sale, evidence of the co