|

|

|

Drug-induced pharmacodynamic effects manifested in older adults include drug-induced renal toxicity, which can be a major factor when these adults are experiencing other kidney problems.

More than 20 million Americans cite use of marijuana within the past 30 days, according to the National Survey on Drug Use and Health (NSDUH). More than 8 million admit to using it almost every day.

Certain rare plants containing cyanide include apricot pits and a type of potato called cassava. Fortunately, only chronic or massive ingestion of any of these plants can lead to serious poisoning.

More than 30% of American adults, and about 12% of children utilize health care approaches that were developed outside of conventional medicine.

Eating food that has been cooked with poppy seeds may cause you to fail a drug screening test, because the seeds contain enough opiate alkaloids to register as a positive.

A freshly applied autograft. Note that the donor skin has been perforated so that it can be stretche

A freshly applied autograft. Note that the donor skin has been perforated so that it can be stretche

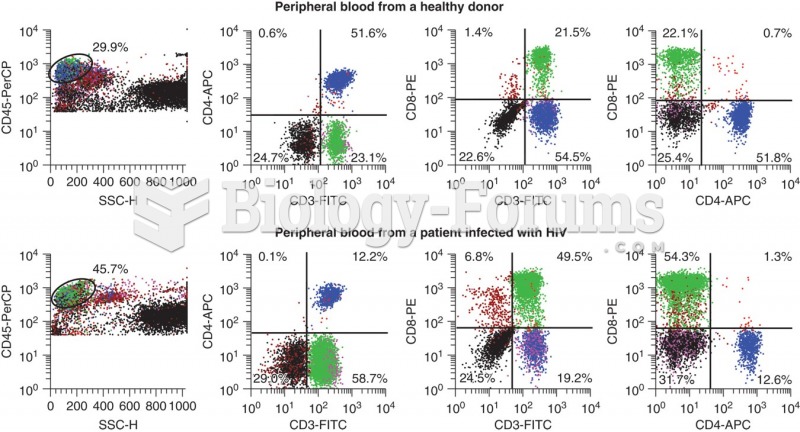

Flow scattergrams showing results on the top set from a healthy donor and on the bottom set from a ...

Flow scattergrams showing results on the top set from a healthy donor and on the bottom set from a ...