|

|

|

Did you know?

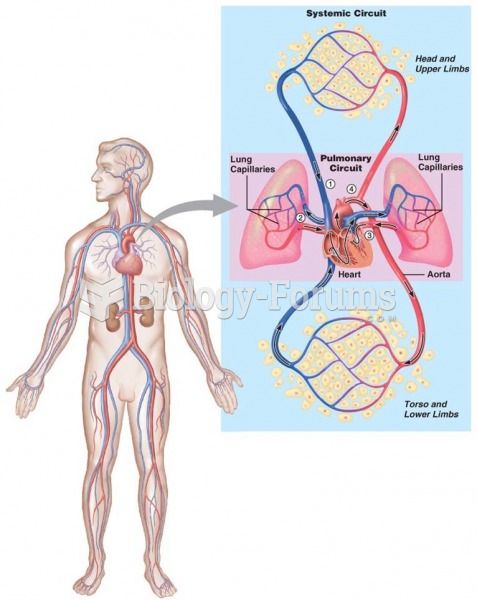

Russia has the highest death rate from cardiovascular disease followed by the Ukraine, Romania, Hungary, and Poland.

Did you know?

Medication errors are three times higher among children and infants than with adults.

Did you know?

The average adult has about 21 square feet of skin.

Did you know?

The calories found in one piece of cherry cheesecake could light a 60-watt light bulb for 1.5 hours.

Did you know?

Astigmatism is the most common vision problem. It may accompany nearsightedness or farsightedness. It is usually caused by an irregularly shaped cornea, but sometimes it is the result of an irregularly shaped lens. Either type can be corrected by eyeglasses, contact lenses, or refractive surgery.