|

|

|

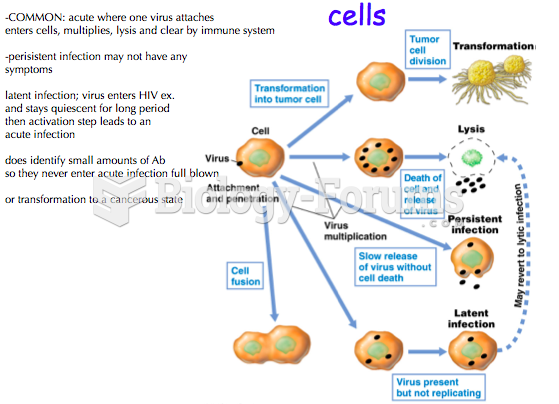

About one in five American adults and teenagers have had a genital herpes infection—and most of them don't know it. People with genital herpes have at least twice the risk of becoming infected with HIV if exposed to it than those people who do not have genital herpes.

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

About 60% of newborn infants in the United States are jaundiced; that is, they look yellow. Kernicterus is a form of brain damage caused by excessive jaundice. When babies begin to be affected by excessive jaundice and begin to have brain damage, they become excessively lethargic.

Approximately one in four people diagnosed with diabetes will develop foot problems. Of these, about one-third will require lower extremity amputation.

The tallest man ever known was Robert Wadlow, an American, who reached the height of 8 feet 11 inches. He died at age 26 years from an infection caused by the immense weight of his body (491 pounds) and the stress on his leg bones and muscles.