|

|

|

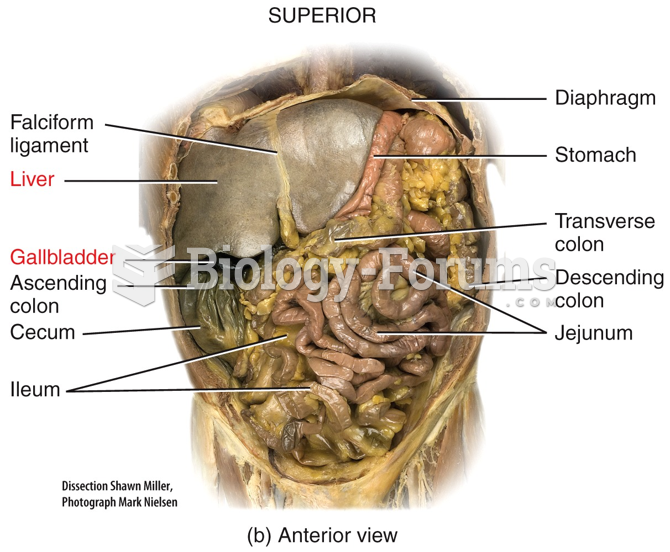

The average human gut is home to perhaps 500 to 1,000 different species of bacteria.

Amphetamine poisoning can cause intravascular coagulation, circulatory collapse, rhabdomyolysis, ischemic colitis, acute psychosis, hyperthermia, respiratory distress syndrome, and pericarditis.

Most fungi that pathogenically affect humans live in soil. If a person is not healthy, has an open wound, or is immunocompromised, a fungal infection can be very aggressive.

Many supplement containers do not even contain what their labels say. There are many documented reports of products containing much less, or more, that what is listed on their labels. They may also contain undisclosed prescription drugs and even contaminants.

Malaria was not eliminated in the United States until 1951. The term eliminated means that no new cases arise in a country for 3 years.