Answer to Question 1

Short-term liquidity

PVC Pipes current and quick ratios increased slightly and both are above one. The cash flow liquidity ratio is below one in and has dropped by half in 2015 . This could be a result of a decrease in cash from operations (CFO), marketable securities and the cash balance. The cash conversion cycle is stable from 2014 to 2015, but the components that make up the cycle have not been stable. The average collection period has increased seven days, inventory days held grew by eight days, and the days payable outstanding grew 14 days, offsetting the negative effects of a deteriorating collection period and inventory turnover. The firm needs to tighten up their credit policy and monitor the increasing days inventory is held. It is also important that the days payable outstanding not increase more in the future or the firm may risk the loss of suppliers.The short-term liquidity for PVC Pipes is adequate, but the firm needs to monitor the above-mentioned items.

Operating efficiency

The fixed and total asset turnover ratios have increased as a result of sales increasing and/or fixed and total assets decreasing.

Capital structure and long-term solvency

The capital structure of PVC Pipes is risky. Long-term debt has increased and total debt is now 67 .10 relative to total assets. The coverage ratios, both accrual and cash-based, have all declined. The accrual-based ratios are now negative as a result of a net loss in 2015 . Cash interest coverage is still positive, but decreasing. The cash flow adequacy ratio is dropping rapidly and has been below one both years. The firm cannot cover capital expenditures, debt repayments and dividends with CFO. If PVC Pipes is paying dividends that would not be a good strategy given the losses and the risky capital structure. The firm needs to improve its cash flow and pay down debt to improve its balance sheet.

Profitability

Profitability is poor for PVC Pipes. The gross profit margin has declined and is now at 10 .10.Either costs are increasing or selling prices are being lowered. PVC Pipes needs to control costs better or pass increased costs onto customers to improve the gross profit margin. Operating and net profit in 2015 have turned to losses in 2015 . Further investigation of the cause of these losses is warranted. Due to the financial leverage used in the firm, the effect on return on equity has been magnified in both 2014 (positively) and in 2015 (negatively). As stated previously, despite the accrual-based losses the firm has incurred, PVC Pipes still generates positive cash from operations. Cash flow margin and cash return on assets have declined from the 2014 levels but are still positive. PVC Pipes' long-term solvency is adequate. The increased use of debt is probably a result of the underlying causes of the profit deterioration.

Answer to Question 2

c

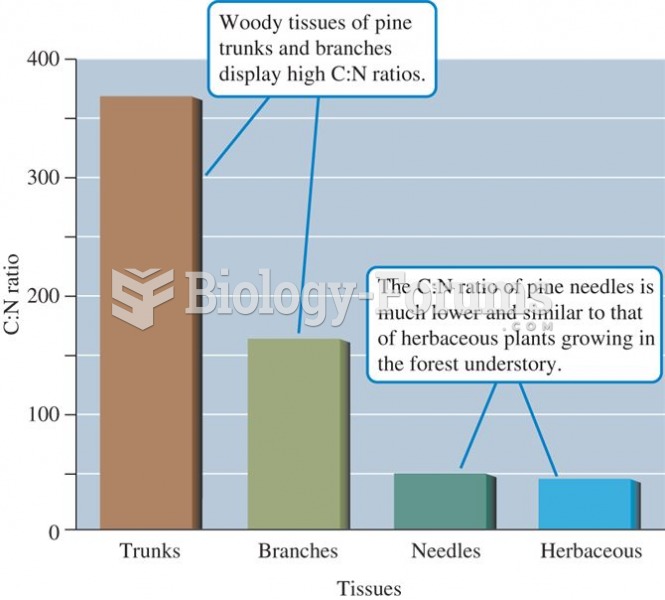

C:N ratios differ a great deal among the tissues of pines and between the woody tissues of pines and

C:N ratios differ a great deal among the tissues of pines and between the woody tissues of pines and

The world has been horrified recently at a U.S. Congress so polarized and paralyzed that it cannot p

The world has been horrified recently at a U.S. Congress so polarized and paralyzed that it cannot p