|

|

|

The word drug comes from the Dutch word droog (meaning "dry"). For centuries, most drugs came from dried plants, hence the name.

Disorders that may affect pharmacodynamics include genetic mutations, malnutrition, thyrotoxicosis, myasthenia gravis, Parkinson's disease, and certain forms of insulin-resistant diabetes mellitus.

On average, the stomach produces 2 L of hydrochloric acid per day.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.

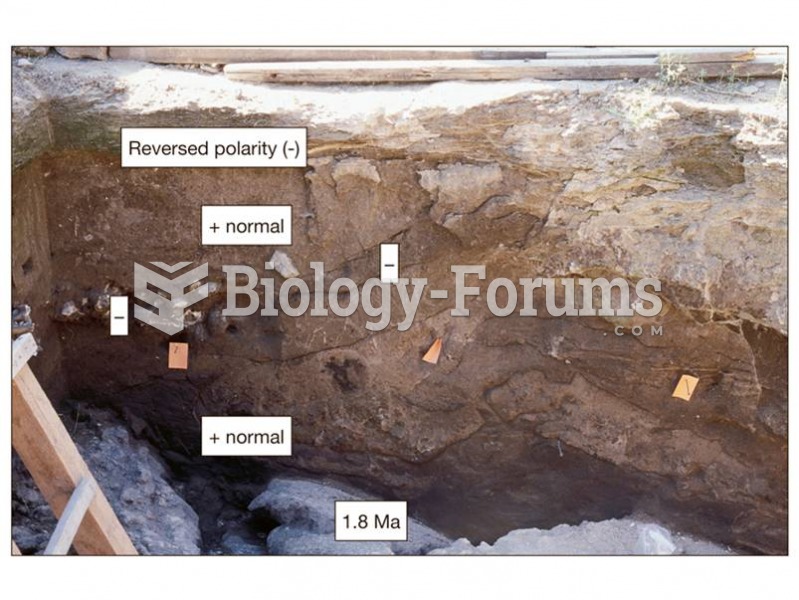

The basalt below the hominins is dated to 1.8 million years ago, and the geomagnetic polarity of the

The basalt below the hominins is dated to 1.8 million years ago, and the geomagnetic polarity of the

Candidates for jobs are sometimes rejected when the prospective employer finds negative images or ...

Candidates for jobs are sometimes rejected when the prospective employer finds negative images or ...