Answer to Question 1

1. Order taking Customer batch-level

Product handling Customer output-unit-level

Delivery Customer batch-level

Expedited delivery Customer batch-level

Restocking Customer batch-level

Visits to customers Customer sustaining-level

Sales commissions Customer batch-level

2. Customer-level operating income based on expected cost of orders:

Customers

AC DC MC JC RC BC

Revenues

30 225; 520; 295; 110; 390; 1,050 6,750 15,600 8,850 3,300 11,700 31,500

Less: Returns

30 15; 40; 0; 0; 35; 40 450 1,200 0 0 1,050 1,200

Net Revenues

30 210; 480; 295; 110; 355; 1,010 6,300 14,400 8,850 3,300 10,650 30,300

Cost of goods sold

18 210; 480; 295; 110; 355; 1,010 3,780 8,640 5,310 1,980 6,390 18,180

Gross margin 2,520 5,760 3,540 1,320 4,260 12,120

Customer-level operating costs:

Order taking

15 10; 20; 9; 12; 24; 36 150 300 135 180 360 540

Product handling

1 225; 520; 295; 110; 390; 1,050 225 520 295 110 390 1,050

Delivery

1.20 360; 580; 350; 220; 790; 850 432 696 420 264 948 1,020

Expedited delivery

175 0; 8; 0; 0; 3; 4 0 1,400 0 0 525 700

Restocking

50 3; 2; 0; 0; 1; 5 150 100 0 0 50 250

Visits to customers 125 125 125 125 125 125

Sales commissions

10 10; 20; 9; 12; 24; 36 100 200 90 120 240 360

Total customer-level operating costs 1,182 3,341 1,065 799 2,638 4,045

Customer-level operating income 1,338 2,419 2,475 521 1,622 8,075

3. Customer level operating income based on actual order costs:

Customers

AC DC MC JC RC BC

Revenues

30 225; 520; 295; 110; 390; 1,050 6,750 15,600 8,850 3,300 11,700 31,500

Less: Returns

30 15; 40; 0; 0; 35; 40 450 1,200 0 0 1,050 1,200

Net Revenues

30 210; 480; 295; 110; 355; 1,010 6,300 14,400 8,850 3,300 10,650 30,300

Cost of goods sold

18 210; 480; 295; 110; 355; 1,010 3,780 8,640 5,310 1,980 6,390 18,180

Gross margin 2,520 5,760 3,540 1,320 4,260 12,120

Customer-level operating costs:

Order taking

8 10; 15 20; 8 9; 8 12; 8 24; 8 36 80 300 72 96 192 288

Product handling

1 225; 520; 295; 110; 390; 1,050 225 520 295 110 390 1,050

Delivery

1.20 360; 580; 350; 220; 790; 850 432 696 420 264 948 1,020

Expedited delivery

175 0; 8; 0; 0; 3; 4 0 1,400 0 0 525 700

Restocking

50 3; 2; 0; 0; 1; 5 150 100 0 0 50 250

Visits to customers 125 125 125 125 125 125

Sales commissions

10 10; 20; 9; 12; 24; 36 100 200 90 120 240 360

Total customer-level operating costs 1,112 3,341 1,002 715 2,470 3,793

Customer-level operating income 1,408 2,419 2,538 605 1,790 8,327

Comparing the answers in requirements 2 and 3, it appears that operating income is higher than expected, so the management of KC Corporation would be very pleased with the performance of the salespeople for reducing order costs. Except for DC, all of the customers are more profitable than originally reported.

4. Customer-level operating income based on actual orders and adjusted commissions

Customers

AC DC MC JC RC BC

Revenues

30 225; 520; 295; 110; 390; 1,050 6,750 15,600 8,850 3,300 11,700 31,500

Less: Returns

30 15; 40; 0; 0; 35; 40 450 1,200 0 0 1,050 1,200

Net Revenues

30 210; 480; 295; 110; 355; 1,010 6,300 14,400 8,850 3,300 10,650 30,300

Cost of goods sold

18 210; 480; 295; 110; 355; 1,010 3,780 8,640 5,310 1,980 6,390 18,180

Gross margin 2,520 5,760 3,540 1,320 4,260 12,120

Customer-level operating costs:

Order taking

15 5; 20; 4; 6; 9; 18 75 300 60 90 135 270

Product handling

1 225; 520; 295; 110; 390; 1,050 225 520 295 110 390 1,050

Delivery

1.20 360; 580; 350; 220; 790; 850 432 696 420 264 948 1,020

Expedited delivery

175 0; 8; 0; 0; 3; 4 0 1,400 0 0 525 700

Restocking

50 3; 2; 0; 0; 1; 5 150 100 0 0 50 250

Visits to customers 125 125 125 125 125 125

Sales commissions

10 5; 20; 4; 6; 9; 18 50 200 40 60 90 180

Total customer-level operating costs 1,057 3,341 940 649 2,263 3,595

Customer-level operating income 1,463 2,419 2,600 671 1,997 8,525

5. The behavior of the salespeople is costing KC Corporation 588 in profit (the difference between the incomes in requirements 3 and 4.) Although management thinks the salespeople are saving money based on the budgeted order costs, in reality they are costing the firm money by increasing the costs of orders (1,028 in requirement 3 versus 930 in requirement 4) and at the same time increasing their sales commissions (1,110 in requirement 3 versus 620 in requirement 4). This is not ethical.

KC Corporation needs to change the structure of the sales commission, possibly linking commissions to the overall units sold rather than on number of orders.

Some students might argue that the amount is not material, but in matters of ethics be wary of the slippery slope. Most organizations do not stand for any deviation from ethical principles, regardless of the amount involved. Students can engage in an interesting debate around this point.

Answer to Question 2

F

An alternating pneumatic compression device squeezes the leg tissues causing blood to move toward th

An alternating pneumatic compression device squeezes the leg tissues causing blood to move toward th

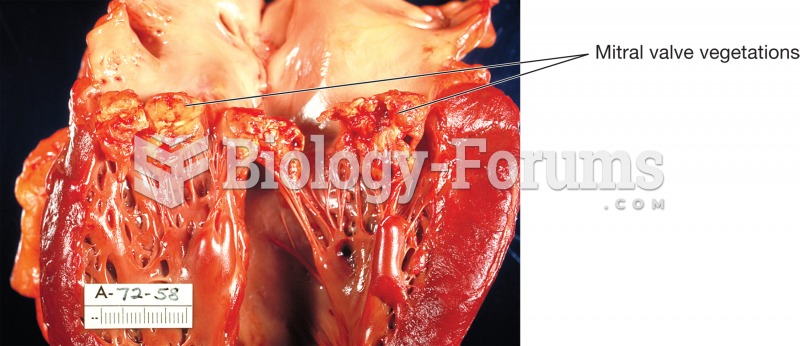

Endocarditis. The human heart has been sectioned to reveal the left ventricle and origin of the aort

Endocarditis. The human heart has been sectioned to reveal the left ventricle and origin of the aort

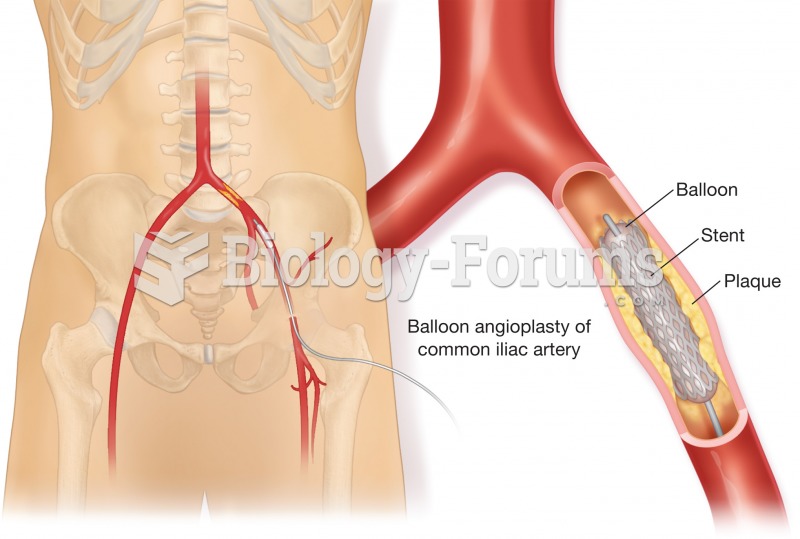

Angioplasty. One form is called balloon angioplasty, shown here. A balloon catheter is threaded into

Angioplasty. One form is called balloon angioplasty, shown here. A balloon catheter is threaded into