Answer to Question 1

C

Answer to Question 2

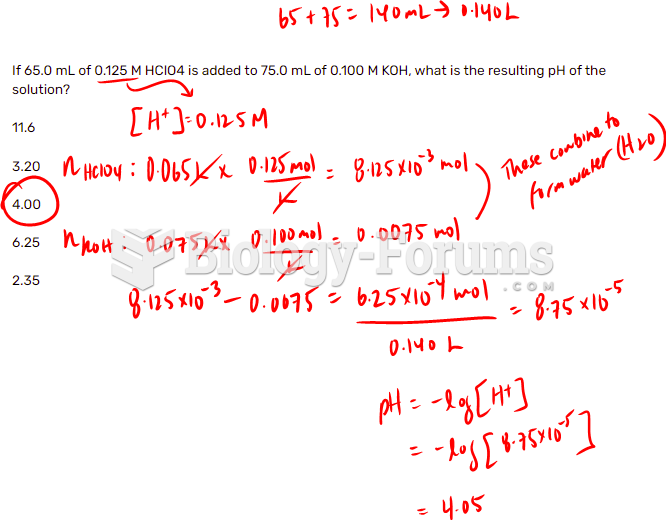

1. Here is the summary output for the monthly regression of Direct Labor Hours on Output Units for Hankuk Electronics:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.2333602

R Square 0.054457

Adjusted R Square 0.0400973

Standard Error 206.18345

Observations 12

ANOVA

df SS MS F Significance F

Regression 1 24483.86 24483.86 0.575933 0.465422344

Residual 10 425116.1 42511.61

Total 11 449600

Coefficients Standard Error t Stat P-value Lower 95 Upper 95

Intercept 345.24 589.07 0.59 0.57 967.29 1657.77

X Variable 1 0.71 0.93 0.76 0.47 1.37 2.79

2. The plot and regression line for monthly direct labor hours on monthly output for Hankuk Electronics are given below:

Economic

plausibility A positive relationship between direct labor hours and monthly output is economically plausible because increased levels of production should lead to the consumption of greater amounts of direct labor.

Goodness of fit r2 = 5.45, Adjusted r2 = - 4

Standard error of regression = 206.18

Terrible fit; in fact, there is no evidence of a linear relationship between the dependent and independent variables. At least one data point represents a significant outlier.

Significance of independent

variables The t-value of 0.76 for output units is not significant at the 0.05 level.

3. Given Inbee's expectation that Hankuk will produce 650 units in January 2014, her best estimate given the linear regression above is that Hankuk will use:

345.24 + (0.71 650 units) = 806.74 direct labor hours.

At an estimated variable cost of 17.50 per direct labor-hour, this implies that Inbee should budget

806.74 17.50 = 14,118

for direct labor costs for January 2014.

Note that 650 units is in the range of output values that were used to find the regression equation and therefore falls in the range of predictability for this model. However, there is substantial uncertainty around the cost estimate of 14,118. In particular, this predicted value relies on the regression point estimate of 0.71 for the marginal impact of output on labor hours. But, the 95 percent confidence interval for the slope of the regression ranges all the way from 1.37 to 2.79, and the predicted cost would vary accordingly. One cannot reject the null hypothesis that output levels have no impact on labor consumption, leaving the budgeted cost estimate a highly speculative one