|

|

|

The use of salicylates dates back 2,500 years to Hippocrates's recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Only one in 10 cancer deaths is caused by the primary tumor. The vast majority of cancer mortality is caused by cells breaking away from the main tumor and metastasizing to other parts of the body, such as the brain, bones, or liver.

In 1844, Charles Goodyear obtained the first patent for a rubber condom.

Critical care patients are twice as likely to receive the wrong medication. Of these errors, 20% are life-threatening, and 42% require additional life-sustaining treatments.

Though the United States has largely rejected the metric system, it is used for currency, as in 100 pennies = 1 dollar. Previously, the British currency system was used, with measurements such as 12 pence to the shilling, and 20 shillings to the pound.

Organisms exhibit a diversity of behaviours, which include (clockwise from upper left), foraging and

Organisms exhibit a diversity of behaviours, which include (clockwise from upper left), foraging and

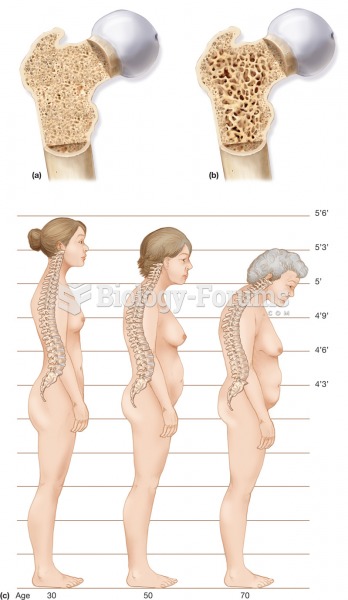

Osteoporosis. (a) A section through normal spongy bone. (b) A section through a bone with osteoporos

Osteoporosis. (a) A section through normal spongy bone. (b) A section through a bone with osteoporos