|

|

|

According to research, pregnant women tend to eat more if carrying a baby boy. Male fetuses may secrete a chemical that stimulates their mothers to step up her energy intake.

Although puberty usually occurs in the early teenage years, the world's youngest parents were two Chinese children who had their first baby when they were 8 and 9 years of age.

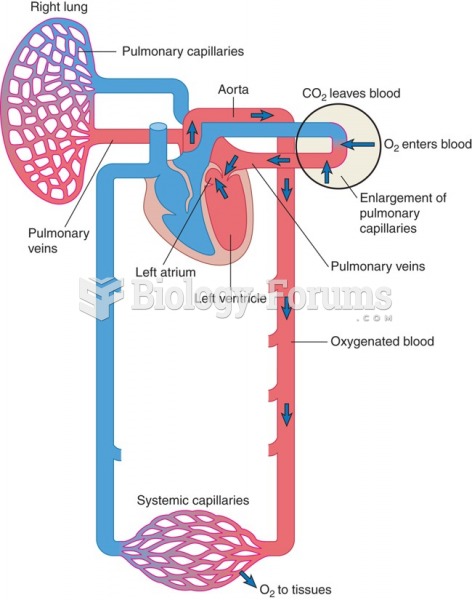

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

The FDA recognizes 118 routes of administration.

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.