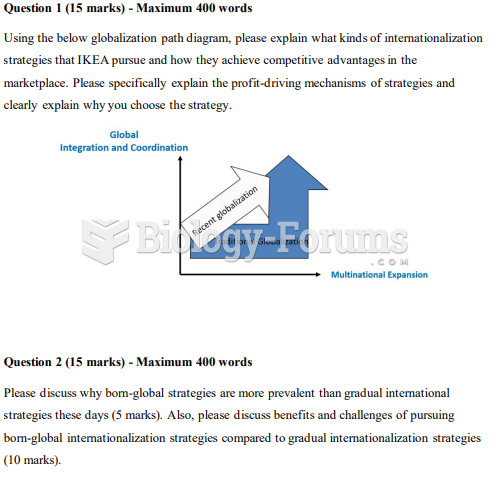

|

|

|

Pregnant women usually experience a heightened sense of smell beginning late in the first trimester. Some experts call this the body's way of protecting a pregnant woman from foods that are unsafe for the fetus.

The most dangerous mercury compound, dimethyl mercury, is so toxic that even a few microliters spilled on the skin can cause death. Mercury has been shown to accumulate in higher amounts in the following types of fish than other types: swordfish, shark, mackerel, tilefish, crab, and tuna.

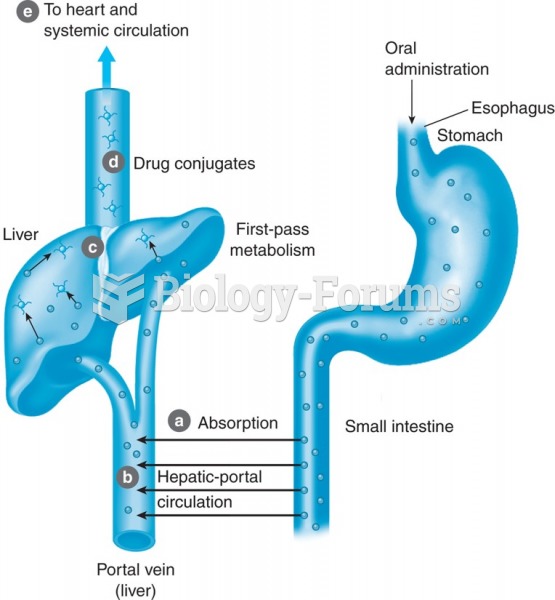

A serious new warning has been established for pregnant women against taking ACE inhibitors during pregnancy. In the study, the risk of major birth defects in children whose mothers took ACE inhibitors during the first trimester was nearly three times higher than in children whose mothers didn't take ACE inhibitors. Physicians can prescribe alternative medications for pregnant women who have symptoms of high blood pressure.

People often find it difficult to accept the idea that bacteria can be beneficial and improve health. Lactic acid bacteria are good, and when eaten, these bacteria improve health and increase longevity. These bacteria included in foods such as yogurt.

The newest statin drug, rosuvastatin, has been called a superstatin because it appears to reduce LDL cholesterol to a greater degree than the other approved statin drugs.