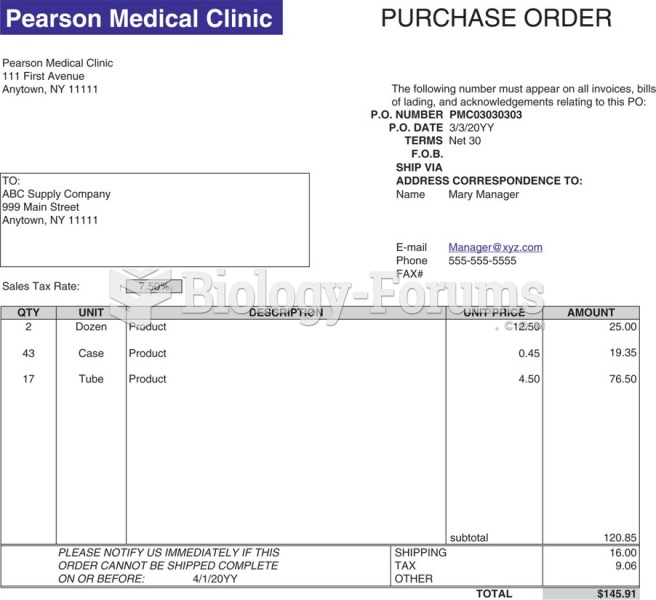

A purchase of supplies on account should be recorded as

a. a debit to Supplies and a credit to Cash.

b. a debit to Accounts Payable and a credit to Supplies.

c. a debit to Supplies and a credit to Accounts Payable.

d. a debit to Supplies Expense and a credit to Accounts Receivable.

e. none of these.

Question 2

Relevant costs, opportunity costs.

Gavin Martin, the general manager of Oregano Software, must decide when to release the new version of Oregano's spreadsheet package, Easyspread 2.0. Development of Easyspread 2.0 is complete; however, the diskettes, compact discs, and user manuals have not yet been produced. The product can be shipped starting July 1, 2014.

The major problem is that Oregano has overstocked the previous version of its spreadsheet package, Easyspread 1.0. Martin knows that once Easyspread 2.0 is introduced, Oregano will not be able to sell any more units of Easyspread 1.0. Rather than just throwing away the inventory of Easyspread 1.0, Martin is wondering if it might be better to continue to sell Easyspread 1.0 for the next three months and introduce Easyspread 2.0 on October 1, 2014, when the inventory of Easyspread 1.0 will be sold out.

The following information is available:

Development cost per unit for each product equals the total costs of developing the software product divided by the anticipated unit sales over the life of the product. Marketing and administrative costs are fixed costs in 2014, incurred to support all marketing and administrative activities of Oregano Software. Marketing and administrative costs are allocated to products on the basis of the budgeted revenues of each product. The preceding unit costs assume Easyspread 2.0 will be introduced on October 1, 2014.

Required:

1. On the basis of financial considerations alone, should Martin introduce Easyspread 2.0 on July 1, 2014, or wait until October 1, 2014? Show your calculations, clearly identifying relevant and irrelevant revenues and costs.

2. What other factors might Gavin Martin consider in making a decision?