Answer to Question 1

B

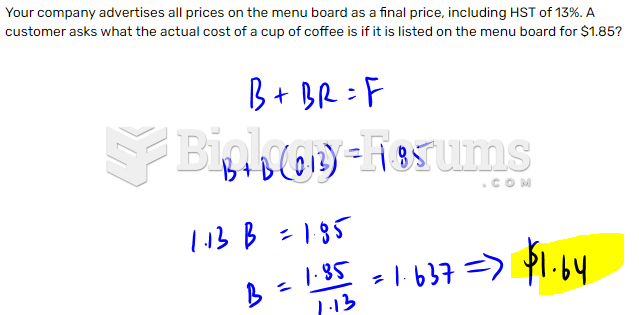

Answer to Question 2

1a.To breakeven, Carlisle Engine Company must sell 1,200 units. This amount represents the point where revenues equal total costs.

Let Q denote the quantity of engines sold.

Revenue = Variable costs + Fixed costs

4,000Q = 1000Q + 4,800,000

3,000Q = 4,800,000

Q = 1,600 units

Breakeven can also be calculated using contribution margin per unit.

Contribution margin per unit = Selling price Variable cost per unit = 4,000 1,000 = 3,000

Breakeven = Fixed Costs Contribution margin per unit

= 4,800,000 3,000

= 1,600 units

1b. To achieve its net income objective, Carlisle Engine Company must sell 2,100 units. This amount represents the point where revenues equal total costs plus the corresponding operating income objective to achieve net income of 1,200,000.

Revenue = Variable costs + Fixed costs + Net income (1 Tax rate)

4,000Q = 1,000Q + 4,800,000 + 1,200,000 (1 0.20)

4,000Q = 1,000Q + 4,800,000 + 1,500,000

Q = 2,100 units

2. None of the alternatives will help Carlisle Engineering achieve its net income objective of 1,200,000. Alternative b, where variable costs are reduced by 300 and selling price is reduced by 400 resulting in 1,750 additional units being sold through the end of the year, yields the highest net income of 1,180,000. Carlisle's managers should examine how to modify Alternative b to further increase net income. For example, could variable costs be decreased by more than 300 per unit or selling prices decreased by less than 400? Calculations for the three alternatives are shown below.

Alternative a

Revenues = (4,000 400) + (3,400a 2,100) = 8,740,000

Variable costs = 1,000 2,500b = 2,500,000

Operating income = 8,740,000 2,500,000 4,800,000 = 1,440,000

Net income = 1,440,000 (1 0.20) = 1,152,000

a4,000 (4,000 0.15) ; b400 units + 2,100 units.

Alternative b

Revenues = (4,000 400) + (3,600a 1,750) = 7,900,000

Variable costs = (1,000 400) + (700b 1,750) = 1,625,000

Operating income = 7,900,000 1,625,000 4,800,000 = 1,475,000

Net income = 1,475,000 (1 0.20) = 1,180,000

a4,000 400 ; b1,000 300.

Alternative c

Revenues = (4,000 400) + (2,800a 2,200) = 7,760,000

Variable costs = 1,000 2,600b = 2,600,000

Operating income = 7,760,000 2,600,000 4,320,000c = 840,000

Net income = 840,000 (1 0.20) = 672,000

a4,000 (4,000 0.30); b400 units + 2,200nits; c4,800,000 (4,800,000 0.10)