Answer to Question 1

C

Answer to Question 2

1. The budget for fixed manufacturing overhead is 4,000 units 6 machine-hours 15 machine-hours/unit = 360,000.

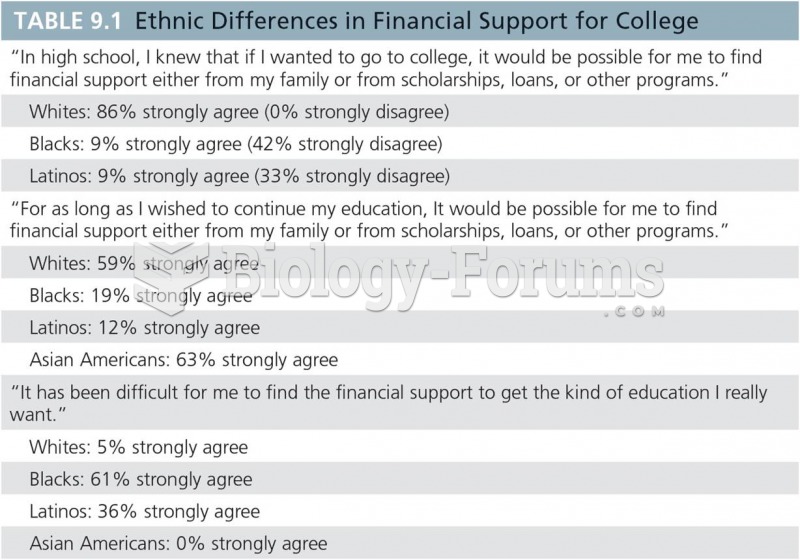

An overview of the 4-variance analysis is:

4-Variance

Analysis Spending

Variance Efficiency

Variance Production -

Volume Variance

Variable

Manufacturing

Overhead

17,800 U

16,000 U

Never a Variance

Fixed

Manufacturing

Overhead

13,000 U

Never a Variance

36,000 F

Solution Exhibit 8- 22 has details of these variances.

A detailed comparison of actual and flexible budgeted amounts is:

Actual Flexible Budget

Output units (auto parts) 4,400 4,400

Allocation base (machine-hours) 28,400 26,400a

Allocation base per output unit 6.45b 6.00

Variable MOH 245,000 211,200c

Variable MOH per hour 8.63d 8.00

Fixed MOH 373,000 360,000e

Fixed MOH per hour 13.13f

a4,400 units 6.00 machine-hours/unit = 26,400 machine-hours

b28,400 4,400 = 6.45 machine-hours per unit

c 4,400 units 6.00 machine-hours per unit 8.00 per machine-hour = 211,200

d 245,000 28,400 = 8.63

e 4,000 units 6.00 machine-hours per unit 15 per machine-hour = 360,000

f 373,000 28,400 = 13.13

2. Variable Manufacturing Overhead Control 245,000

Accounts Payable Control and other accounts 245,000

Work-in-Process Control 211,200

Variable Manufacturing Overhead Allocated 211,200

Variable Manufacturing Overhead Allocated 211,200

Variable Manufacturing Overhead Spending Variance 17,800

Variable Manufacturing Overhead Efficiency Variance 16,000

Variable Manufacturing Overhead Control 245,000

Fixed Manufacturing Overhead Control 373,000

Wages Payable Control, Accumulated Depreciation

Control, etc. 373,000

Work-in-Process Control 396,000

Fixed Manufacturing Overhead Allocated 396,000

Fixed Manufacturing Overhead Allocated 396,000

Fixed Manufacturing Overhead Spending Variance 13,000

Fixed Manufacturing Overhead Production-Volume Variance 36,000

Fixed Manufacturing Overhead Control 373,000

3. Individual fixed manufacturing overhead items are not usually affected very much by day-to-day control. Instead, they are controlled periodically through planning decisions and budgeting procedures that may sometimes have horizons covering six months or a year (for example, management salaries) and sometimes covering many years (for example, long-term leases and depreciation on plant and equipment).

4. The fixed overhead spending variance is caused by the actual realization of fixed costs differing from the budgeted amounts. Some fixed costs are known because they are contractually specified, such as rent or insurance, although if the rental or insurance contract expires during the year, the fixed amount can change. Other fixed costs are estimated, such as the cost of managerial salaries, which may depend on bonuses and other payments not known at the beginning of the period. In this example, the spending variance is unfavorable, so actual FOH is greater than the budgeted amount of FOH.

The fixed overhead production volume variance is caused by production being over or under expected capacity. You may be under capacity when demand drops from expected levels or if there are problems with production. Over capacity is usually driven by favorable demand shocks or a desire to increase inventories. The fact that there is a favorable volume variance indicates that production exceeded the expected level of output (4,400 units actual relative to a denominator level of 4,000 output units).

EXHIBIT 8- 22

Actual Costs

Incurred

(1)

Actual Input

Budgeted Rate

(2) Flexible Budget:

Budgeted Input

Allowed for

Actual Output

Budgeted Rate

(3) Allocated:

Budgeted Input

Allowed for

Actual Output

Budgeted Rate

(4)

Variable

MOH

245,000 (28,400 8)

227,200 (4,400 6 8)

211,200 (4,400 6 8)

211,200

Actual Costs Incurred

(1)

Same Budgeted

Lump Sum

(as in Static Budget)

Regardless of

Output Level

(2) Flexible Budget:

Same Budgeted

Lump Sum

(as in Static Budget)

Regardless of

Output Level

(3)

Allocated:

Budgeted Input

Allowed for

Actual Output

Budgeted Rate

(4)

Fixed

MOH

373,000 (4,000 6 15)

360,000 (4,000 6 15)

360,000 (4,400 6 15)

396,000