|

|

|

Signs and symptoms that may signify an eye tumor include general blurred vision, bulging eye(s), double vision, a sensation of a foreign body in the eye(s), iris defects, limited ability to move the eyelid(s), limited ability to move the eye(s), pain or discomfort in or around the eyes or eyelids, red or pink eyes, white or cloud spots on the eye(s), colored spots on the eyelid(s), swelling around the eyes, swollen eyelid(s), and general vision loss.

Many medications that are used to treat infertility are injected subcutaneously. This is easy to do using the anterior abdomen as the site of injection but avoiding the area directly around the belly button.

Before a vaccine is licensed in the USA, the Food and Drug Administration (FDA) reviews it for safety and effectiveness. The CDC then reviews all studies again, as well as the American Academy of Pediatrics and the American Academy of Family Physicians. Every lot of vaccine is tested before administration to the public, and the FDA regularly inspects vaccine manufacturers' facilities.

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

An identified risk factor for osteoporosis is the intake of excessive amounts of vitamin A. Dietary intake of approximately double the recommended daily amount of vitamin A, by women, has been shown to reduce bone mineral density and increase the chances for hip fractures compared with women who consumed the recommended daily amount (or less) of vitamin A.

Retrograde pyelography (RP). Note the contrasting of the renal calyces, ureters, and bladder followi

Retrograde pyelography (RP). Note the contrasting of the renal calyces, ureters, and bladder followi

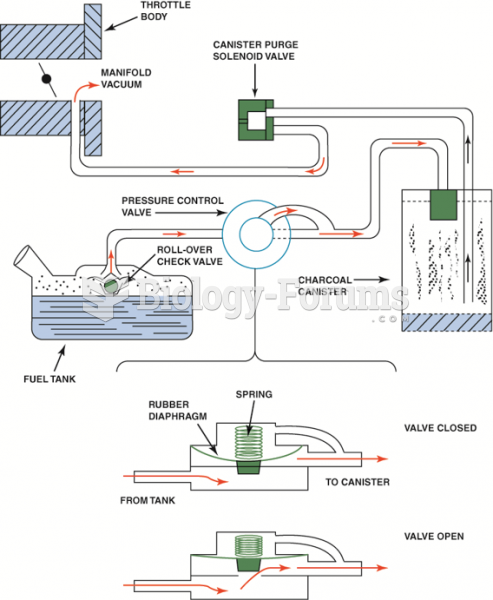

The air flowing into the engine can be directed through long or short runners for best performance ...

The air flowing into the engine can be directed through long or short runners for best performance ...