|

|

|

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

Although the Roman numeral for the number 4 has always been taught to have been "IV," according to historians, the ancient Romans probably used "IIII" most of the time. This is partially backed up by the fact that early grandfather clocks displayed IIII for the number 4 instead of IV. Early clockmakers apparently thought that the IIII balanced out the VIII (used for the number 8) on the clock face and that it just looked better.

There are more bacteria in your mouth than there are people in the world.

As many as 20% of Americans have been infected by the fungus known as Histoplasmosis. While most people are asymptomatic or only have slight symptoms, infection can progress to a rapid and potentially fatal superinfection.

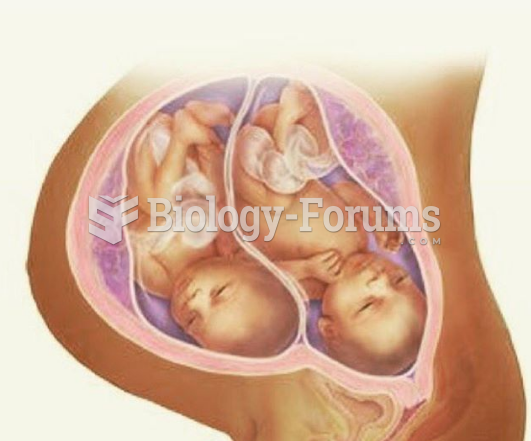

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.