Answer to Question 1

The five parties involved in a credit card transaction are the consumer, the merchant, the clearinghouse, the merchant bank (acquiring bank), and the consumer's card issuing bank. The basic payment transaction process works like this: The consumer first makes an online payment by sending his or her credit card information via an online form at the merchant's website. Once this information is received by the merchant, the merchant software contacts a clearinghouse (a financial intermediary that authenticates credit cards and verifies account balances). The clearinghouse contacts the card issuing bank to verify the account information. Once verified, the issuing bank credits the account of the merchant at the merchant's bank. The debit to the consumer account is transmitted to the consumer in a monthly statement. SSL is involved in sending the consumer's credit card information safely to the merchant's website. When the consumer checks out using the merchant's shopping cart software, a secure tunnel through the Internet is created using SSL/TLS. Using encryption, SSL/TSL secures the session during which credit card information will be sent to the merchant and protects the information from interlopers on the Internet.

There are several limitations to the existing credit card payment system, most importantly involving security, merchant risk, cost, and social equity. The security of the transaction is very poor because neither the merchant nor the consumer can be fully authenticated. The risks merchants face is high. Banks think of Internet credit card orders as the same type of transactions as mail orders or telephone orders. In these transactions, the credit card is not present. There is no way for the merchant to verify the legitimacy of the customer's card or identity before confirming the order. In these transactions, the merchant carries all the risk for fraudulent credit card use. Consumers can disclaim charges even though the items have already been shipped. Merchants also must pay significant charges. These high costs make it unprofitable to sell small items such as individual articles or music tracks over the Internet. Furthermore, credit cards are not very democratic. Millions of young adults and other adult Americans who cannot afford credit cards or who have low incomes and are, therefore, considered poor credit risks cannot participate in e-commerce as it is presently structured in the United States.

Answer to Question 2

EBPP refers to electronic billing presentment and payment systems, which are forms of online payment systems for monthly bills. Analysts expect electronic bill presentment and payment to become one of the fastest growing e-commerce businesses in the United States over the next several years because everyone involved stands to benefit from the process. Billers will cut costs by eliminating printing, paper, envelopes, postage, and the processing of paper checks and payments. Furthermore, EBPP will offer billers an opportunity to enhance customer service and target market. Customers will save time and eliminate checks and postage. Companies can use EBPP to present bills to individual customers electronically or they can contract with a service to handle all billing and payment collection for them. There are four main types of EBPP business models: online banking, biller-direct, mobile, and consolidator. The online banking model is the most widely used today. Consumers share their banking or credit card credentials with the merchant and authorize the merchant to charge the consumer's bank account. This model has the advantage of convenience for the consumer because the payments are deducted automatically, usually with a notice from the bank or the merchant that their account has been debited. In the biller-direct model, consumers are sent bills by e-mail notification, and go to the merchant's website to make payments using their banking credentials. This model has the advantage of allowing the merchant to engage with the consumer by sending coupons or rewards. The biller-direct model is a two-step process, and less convenient for consumers. The mobile model allows consumers to make payments using mobile apps, once again relying on their bank credentials as the source of funds. Consumers are notified of a bill by text message and authorize the payment. The mobile model has several advantages, not least of which is the convenience for consumers of paying bills while using their phones, but also the speed with which bills can be paid in a single step. This is the fastest growing form of EBPP. In the consolidator model, a third party, such as a financial institution or a focused portal such as Intuit's Paytrust, Fiserv's MyCheckFree, Mint Bills, and others, aggregates all bills for consumers and permits one-stop bill payment. This model has the advantage of allowing consumers to see all their bills at one website or app. However, because bills come due at different times, consumers need to check their portals often. The consolidator model faces several challenges. For billers, using the consolidator model means an increased time lag between billing and payment, and inserts an intermediary between the company and its customer.

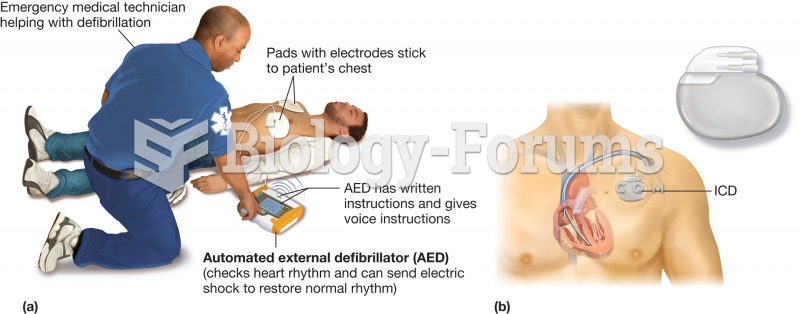

Defibrillator. Defibrillators are devices that supply a voltage charge to the heart in the hope of r

Defibrillator. Defibrillators are devices that supply a voltage charge to the heart in the hope of r

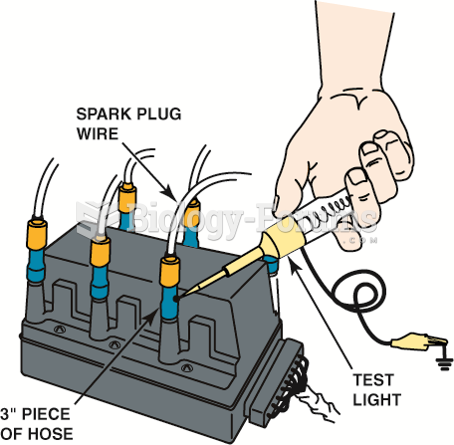

Using a vacuum hose and a grounded test light to ground one cylinder at a time on a DIS. This works ...

Using a vacuum hose and a grounded test light to ground one cylinder at a time on a DIS. This works ...