Answer to Question 1

Answer: 1, 5

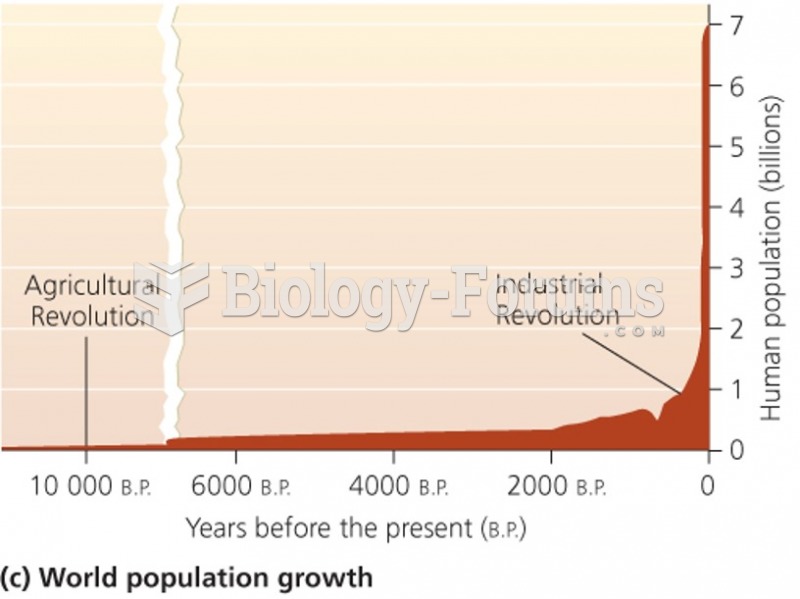

Explanation: 1. Tax cuts maintain expenditures while at the same time reducing revenues that could fund them. Although tax cuts and low interest rates will stimulate the economy in the short run, they are likely to cause a long-term imbalance leading to increasing deficits, lower rates of national savings, higher interest rates, and a slowed economy as well as reductions in government-supported services. All of these factors will lead to a greater scarcity of health resources and more severe effects on the health of the population. Tax cuts will have no impact on chronic diseases, the number of care providers, or access to health care services.

5. Tax cuts maintain expenditures while at the same time reducing revenues that could fund them. Although tax cuts and low interest rates will stimulate the economy in the short run, they are likely to cause a long-term imbalance leading to increasing deficits, lower rates of national savings, higher interest rates, and a slowed economy as well as reductions in government-supported services. All of these factors will lead to a greater scarcity of health resources and more severe effects on the health of the population. Tax cuts will have no impact on chronic diseases, the number of care providers, or access to health care services.

Answer to Question 2

Answer: 4

Explanation: 4. Reimbursement is limited or nonexistent in charity care, so people who utilize this system tend to be uninsured or underinsured. Uncompensated care can lead to cost shifting, where these costs are passed along to those who are able to pay, either out of pocket or through insurance. The consumer price index is not dependent on uncompensated care. Traditionally there is decreased use of technology for underinsured and uninsured populations. There is a finite number of hospital beds, which is unaffected through utilization.