|

|

|

One way to reduce acid reflux is to lose two or three pounds. Most people lose weight in the belly area first when they increase exercise, meaning that heartburn can be reduced quickly by this method.

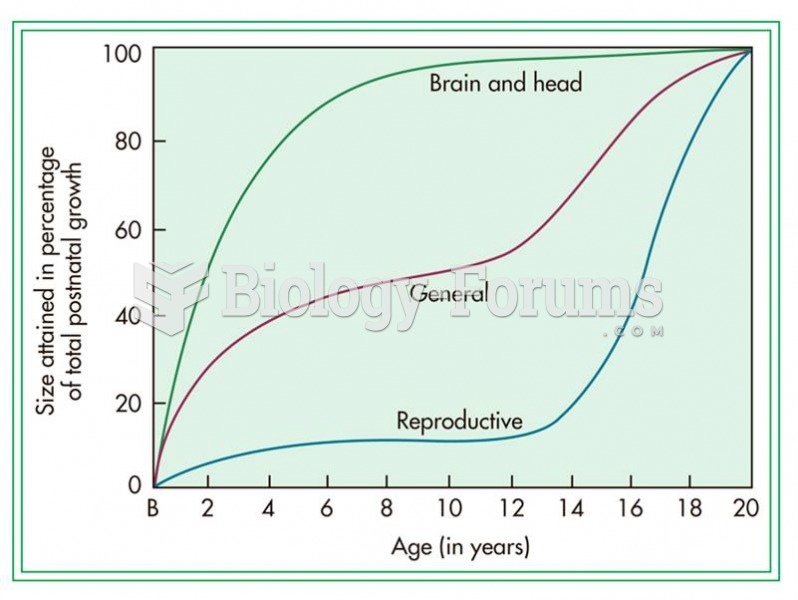

Adolescents often feel clumsy during puberty because during this time of development, their hands and feet grow faster than their arms and legs do. The body is therefore out of proportion. One out of five adolescents actually experiences growing pains during this period.

Though the United States has largely rejected the metric system, it is used for currency, as in 100 pennies = 1 dollar. Previously, the British currency system was used, with measurements such as 12 pence to the shilling, and 20 shillings to the pound.

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.