|

|

|

Amphetamine poisoning can cause intravascular coagulation, circulatory collapse, rhabdomyolysis, ischemic colitis, acute psychosis, hyperthermia, respiratory distress syndrome, and pericarditis.

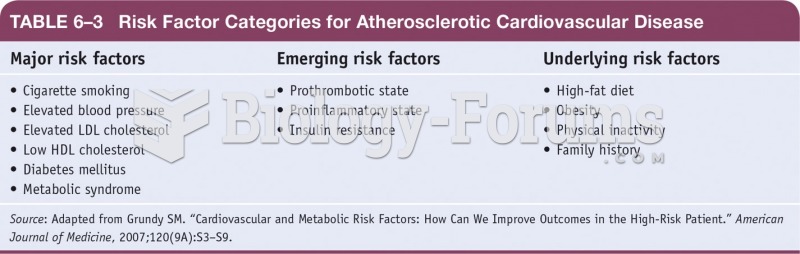

Nearly 31 million adults in America have a total cholesterol level that is more than 240 mg per dL.

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.