|

|

|

The strongest synthetic topical retinoid drug available, tazarotene, is used to treat sun-damaged skin, acne, and psoriasis.

To prove that stomach ulcers were caused by bacteria and not by stress, a researcher consumed an entire laboratory beaker full of bacterial culture. After this, he did indeed develop stomach ulcers, and won the Nobel Prize for his discovery.

Everyone has one nostril that is larger than the other.

Medication errors are three times higher among children and infants than with adults.

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.

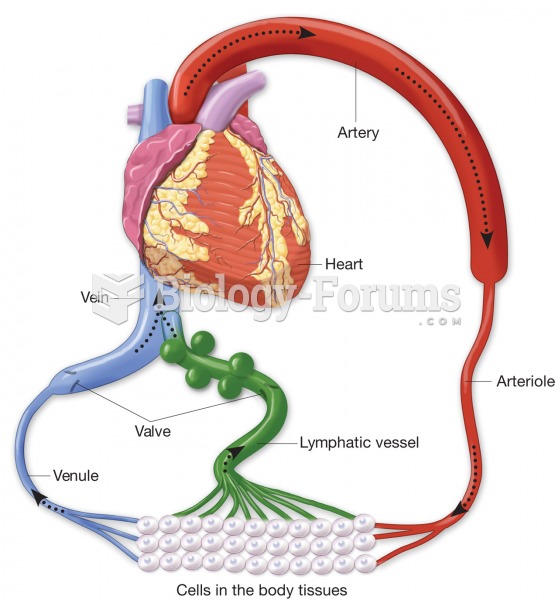

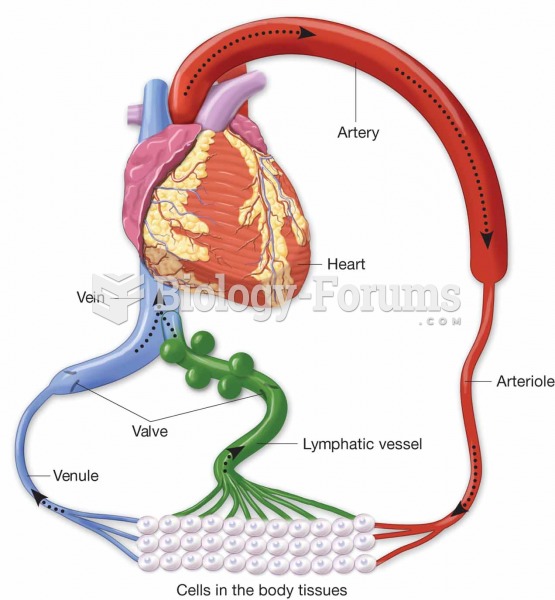

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

Lymphatic vessels pick up excess tissue fluid, purify it in the lymph nodes, and then return it to t

Lymphatic vessels pick up excess tissue fluid, purify it in the lymph nodes, and then return it to t