|

|

|

In 1886, William Bates reported on the discovery of a substance produced by the adrenal gland that turned out to be epinephrine (adrenaline). In 1904, this drug was first artificially synthesized by Friedrich Stolz.

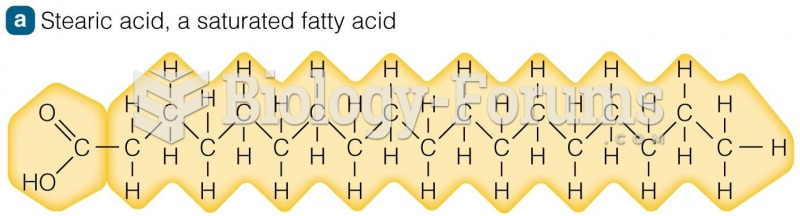

Limit intake of red meat and dairy products made with whole milk. Choose skim milk, low-fat or fat-free dairy products. Limit fried food. Use healthy oils when cooking.

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.