|

|

|

A strange skin disease referred to as Morgellons has occurred in the southern United States and in California. Symptoms include slowly healing sores, joint pain, persistent fatigue, and a sensation of things crawling through the skin. Another symptom is strange-looking, threadlike extrusions coming out of the skin.

A headache when you wake up in the morning is indicative of sinusitis. Other symptoms of sinusitis can include fever, weakness, tiredness, a cough that may be more severe at night, and a runny nose or nasal congestion.

Adults are resistant to the bacterium that causes Botulism. These bacteria thrive in honey – therefore, honey should never be given to infants since their immune systems are not yet resistant.

Malaria was not eliminated in the United States until 1951. The term eliminated means that no new cases arise in a country for 3 years.

The average adult has about 21 square feet of skin.

Distribution of glaciers in North America (a) in the late twentieth century, and (b) 18,000 years ag

Distribution of glaciers in North America (a) in the late twentieth century, and (b) 18,000 years ag

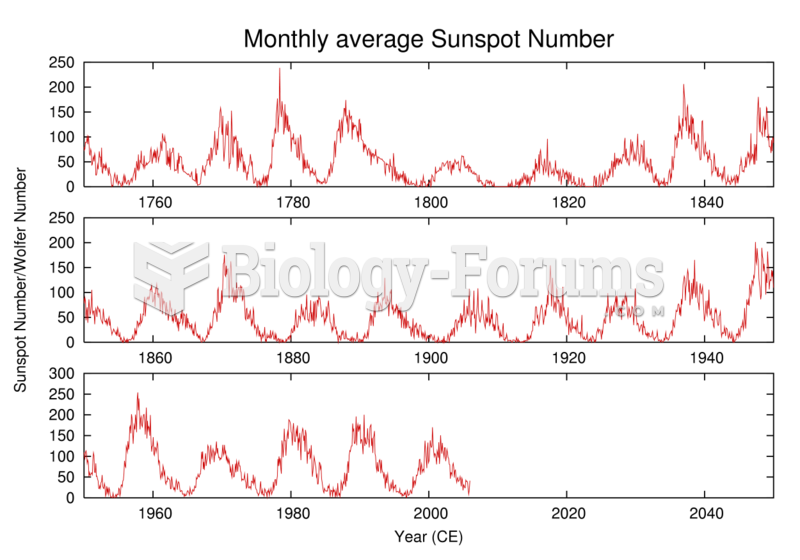

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar