|

|

|

Did you know?

There are more nerve cells in one human brain than there are stars in the Milky Way.

Did you know?

Vaccines prevent between 2.5 and 4 million deaths every year.

Did you know?

Urine turns bright yellow if larger than normal amounts of certain substances are consumed; one of these substances is asparagus.

Did you know?

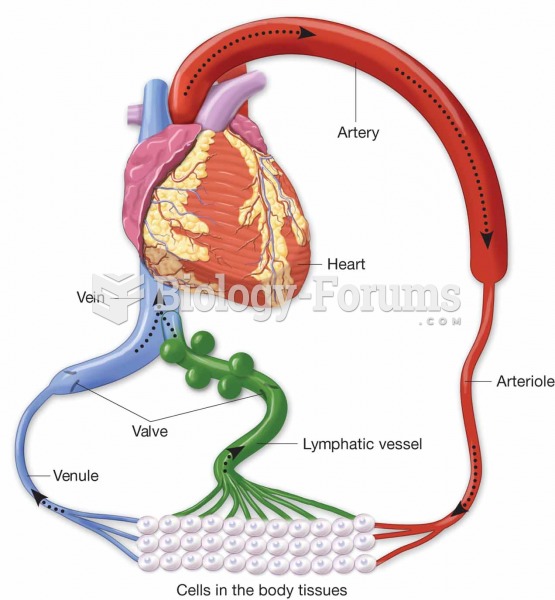

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

Did you know?

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.