|

|

|

The term bacteria was devised in the 19th century by German biologist Ferdinand Cohn. He based it on the Greek word "bakterion" meaning a small rod or staff. Cohn is considered to be the father of modern bacteriology.

There are 20 feet of blood vessels in each square inch of human skin.

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

The tallest man ever known was Robert Wadlow, an American, who reached the height of 8 feet 11 inches. He died at age 26 years from an infection caused by the immense weight of his body (491 pounds) and the stress on his leg bones and muscles.

The Centers for Disease Control and Prevention (CDC) was originally known as the Communicable Disease Center, which was formed to fight malaria. It was originally headquartered in Atlanta, Georgia, since the Southern states faced the worst threat from malaria.

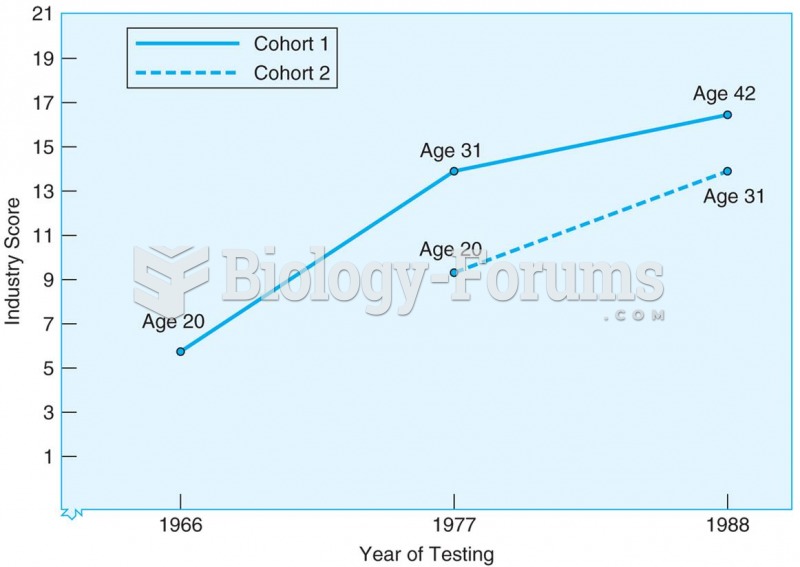

Results from sequential study of two cohorts tested at three ages and at three different points in t

Results from sequential study of two cohorts tested at three ages and at three different points in t

In 2008, the U.S. economy suffered a gaping wound as several trillion dollars were ripped out of it.

In 2008, the U.S. economy suffered a gaping wound as several trillion dollars were ripped out of it.

A sidewheeler on the Mississippi. In 1856 Samuel Clemens became an apprentice to a steamboat pilot a

A sidewheeler on the Mississippi. In 1856 Samuel Clemens became an apprentice to a steamboat pilot a